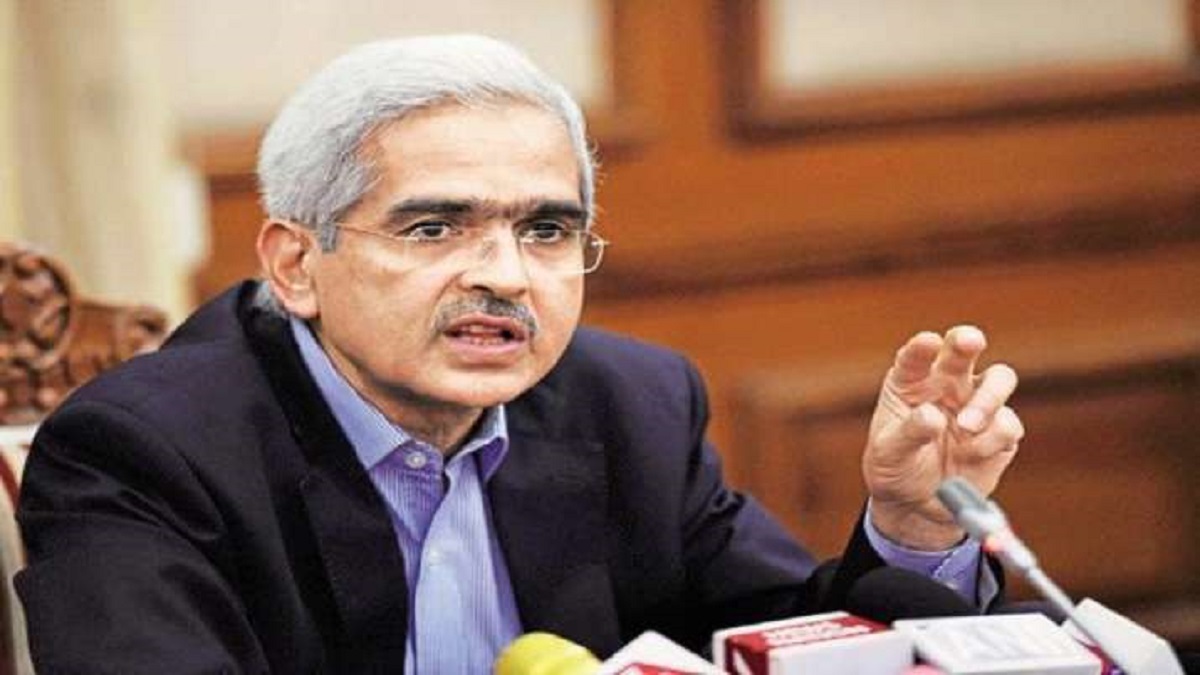

A day after Finance Minister Nirmala Sitharaman announced ₹1.7 trillion stimuli for economy hit and bruised by novel coronavirus pandemic, Reserve Bank of India governor Shaktikanta Das announced series of big-bang moves to further de-stress the impact from 21-day lockdown. RBI governor announced a massive 75 basis points cut in repo rate and further 90 basis points cut in reverse repo rate (which sets the floor of the liquidity adjustment facility (LAF) corridor). Repo rate is the key interest rate at which the RBI lends short-term funds to commercial banks. Shaktikanta Das also announced a 100 bps cut in cash reserver ratio (CRR) to bring more liquidity in the system. To ease the pressure on people who were staring at loan defaults, RBI asked banks to announce a 3-month pause on all EMIs. The RBI Governor further said that macroeconomic fundamentals are stronger than those in the aftermath of the 2008 financial market crisis adding that the banking system in India is safe, deposits are safe in private banks, therefore, the public should not resort to panic withdrawal. Das added that living in an extraordinary situation, war effort needs to be mounted against coronavirus using conventional, unconventional tools. He further added that the RBI is at work and is calibrating action to meet any liquidity mode. The global slowdown can deepen with adverse implication for India, however, crude oil slump an upside indication for the country.

RBI announces massive cut in repo rate; 3 months moratorium for loan EMIs | Key Takeaways

- Repo rate reduced by 75 basis points to 4.4 per cent.

- Reverse repo-rate reduced by 90 basis points to 4 per cent.

- RBI permits all lending institutions to allow a 3-month moratorium on payment of instalments on term loans.

- Rs 3.74 lakh crore liquidity to be injected into the system through measures announced today.

- CRR cut from 4 per cent to 3 per cent for all banks for a period of one year.

- RBI announced that all Banks, HFCs, NBFCs are allowed 3 months moratorium for EMI.

- Macroeconomic fundamentals are stronger than those in the aftermath of 2008 financial market crisis.

- Banking system in India is safe and also deposits in private banks. People should not resort to panic withdrawals.

BREAKDOWN OF RBI's BIG-BANG ANNOUNCEMENT

- All commercial banks (including regional rural banks, small finance banks and local area banks), co-operative banks, all-India Financial Institutions, and NBFCs (including housing finance companies and micro-finance institutions) (“lending institutions”) are being permitted to allow a moratorium of three months on payment of instalments in respect of all term loans outstanding as on March 1, 2020.

- The moratorium on term loans, the deferring of interest payments on working capital and the easing of working capital financing will not qualify as a default for the purposes of supervisory reporting and reporting to credit information companies (CICs) by the lending institutions. Hence, there will be no adverse impact on the credit history of the beneficiaries.

ALSO READ | Highlights from RBI Governor Shaktikanta Das' press briefing