As the deadline for linking the PAN and Aadhaar has been extended, it is important to check if PAN and Aadhaar cards are already linked or not. Non-compliance with this rule will not only invite penalty but also unlinked PAN cards will become inoperative.

The Income Tax Department recently took to Twitter to remind taxpayers about the approaching deadline for linking PAN and Aadhaar. All PAN card holders who do not belong to the exempt category are required to link their PAN with Aadhaar by June 30, 2023, as per the IT Act of 1961. The Income Tax Department urged taxpayers to link their PAN and Aadhaar before the deadline to avoid any inconvenience.

To check the status of your PAN-Aadhaar linking, follow these steps:

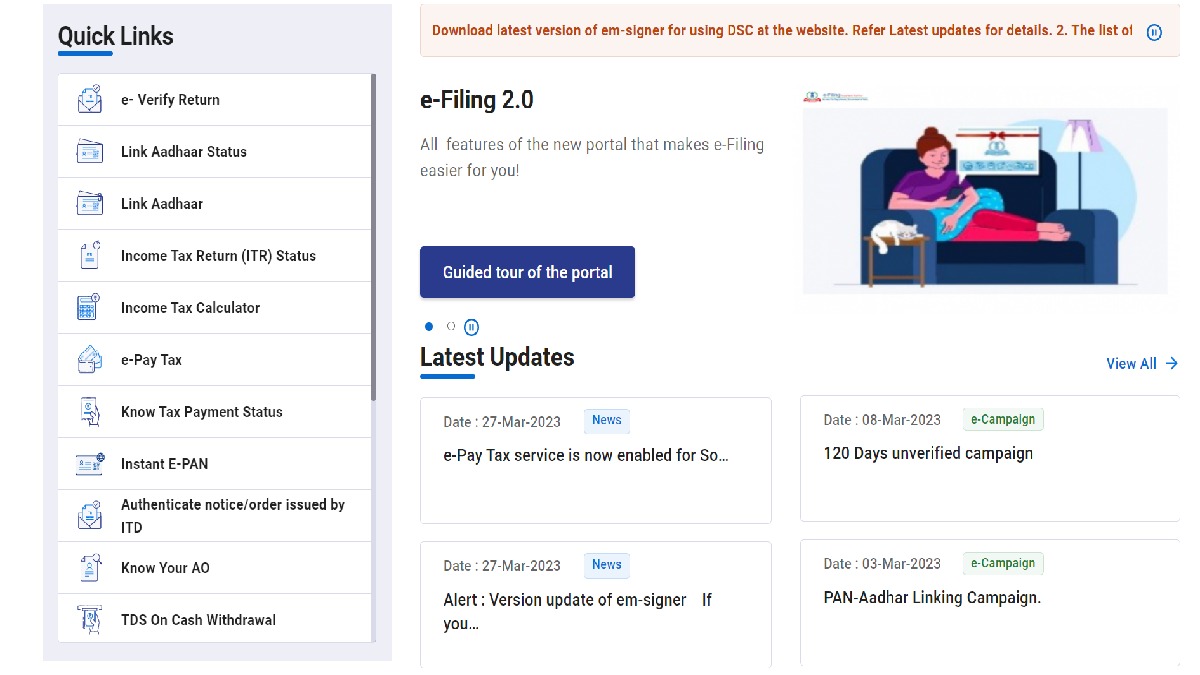

1. Go, the official website of the Income Tax Department.

2. Click on "Quick Links" located on the left side of the page and select the "Link Aadhaar Status" option.

3. On the next page, enter your 10-digit PAN number and 12-digit Aadhaar number in the respective fields.

4. Go to the "View Link Aadhaar Status".

5. If your Aadhaar number is displayed on the screen, it means your PAN and Aadhaar cards are already linked.

6. If the Aadhaar number is not displayed, it means that you need to link your PAN and Aadhaar cards as soon as possible to avoid any penalties or issues with tax filing.

If you fail to link your PAN with your Aadhaar by June 30, several consequences will follow, including:

1. Inoperative PAN: Your PAN will become inoperative until you link it with your Aadhaar. This means that you will not be able to use your PAN for any financial transactions or income tax purposes until the linking is done.

2. Higher TDS/TCS rate: If your PAN is not linked with Aadhaar, any TDS (Tax Deducted at Source) or TCS (Tax Collected at Source) deduction will attract a higher rate applicable to PAN not present. This means that you will have to pay a higher tax amount, which could significantly impact your finances.

3. Restrictions on stock trading: Investors will not be able to carry out any transactions in NSE (National Stock Exchange) or BSE (Bombay Stock Exchange) without linking their PAN with Aadhaar. This means that you will not be able to buy or sell shares until the PAN and Aadhaar are linked.

4. Banking services limitations: You will not be able to perform many banking services without linking your PAN with Aadhaar, including:

Booking a Fixed Deposit above Rs. 50,000.

Depositing cash above Rs. 50,000.

Obtaining a new Debit/Credit Card.

Investing or redeeming your Mutual Funds.

Purchasing any foreign currency beyond Rs 50,000.