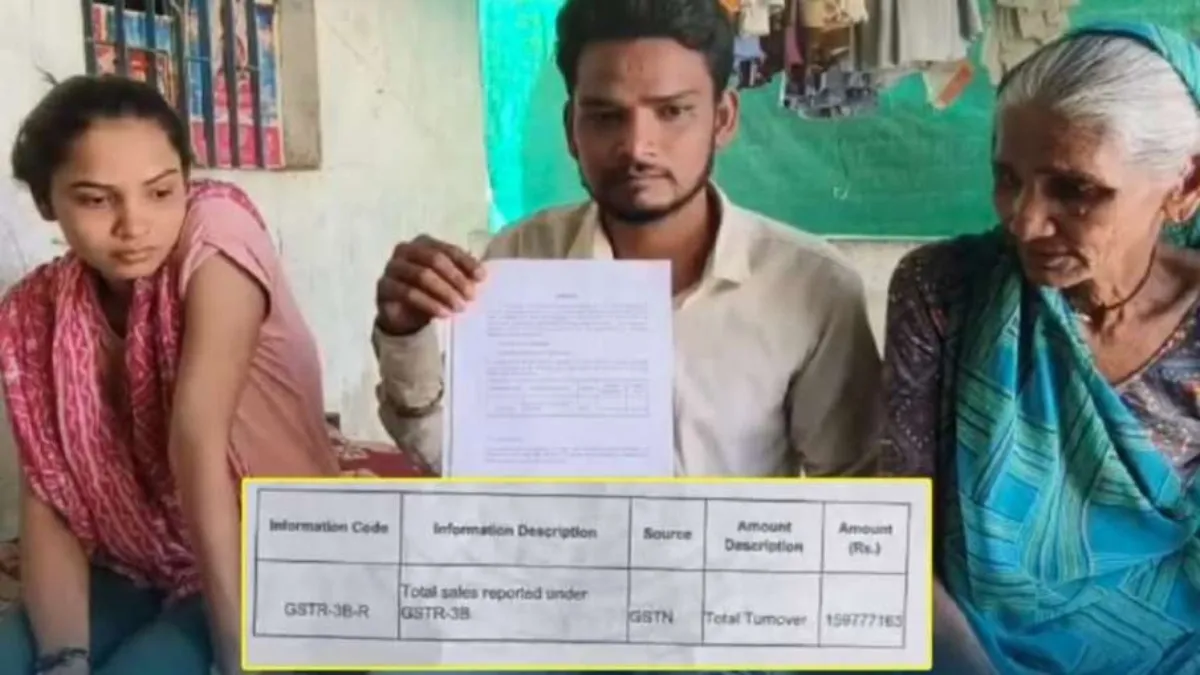

In an almost surreal turn of events, a man from the small village of Ratanpur in Gujarat's Sabarkantha district has received a tax notice demanding a whopping rs 36 crore, leaving his family in a state of utter disbelief. What makes this case even more bizarre is that Jiteshbhai Makwana, the recipient of the notice, earns just ₹12,000 a month working at a private company in Ahmedabad. His family, already struggling to make ends meet, is now left wondering how they could ever pay such a monumental sum.

Jiteshbhai, who lives with his wife, two children, and his mother and sister, had been living a relatively quiet life, working hard to provide for his family. He even qualified for the Indira Awas Yojana, a government scheme aimed at helping the underprivileged with housing. However, all that changed when the Income Tax Department issued a notice demanding Rs 36 crore for the financial year 2021-22.

A notice that left them stunned

The notice has shaken the family to its core. With just Rs 12 in his bank account and barely enough income to cover daily expenses, Jiteshbhai has no idea how he will manage to pay this astronomical sum. "I make Rs 12,000 a month, and I’m told to pay Rs 36 crore? It’s like a bad dream," Jiteshbhai told reporters, his voice heavy with disbelief.

The family’s reaction to the notice has been one of despair, with his mother, sister, and wife all reduced to tears. They even reported the matter to the local police, but were met with the same response: "You need to pay the money." It seems that no one knows how to help them, and the family is now looking to the government and the judicial system for some kind of resolution.

A daily struggle: The reality of poverty

Jiteshbhai’s daily reality is far from the world of high finance that the tax notice seems to belong to. The family survives on meagre wages, often earning between Rs 200 to Rs 350 a day through various odd jobs. In addition to Jiteshbhai, his family consists of his widowed mother, his sister Bhavnavaben, and his wife and children. The thought of having to pay Rs 36 crore is both ludicrous and heartbreaking to them.

"The whole family is devastated," said Bhavnavaben, Jitesh’s sister. "My brother does small jobs to earn a living, and now they are asking us for a sum we can't even fathom. How are we supposed to pay this?"

The Runaround: No one has answers

When Jiteshbhai approached the Income Tax office to explain his situation, he was told he still had to pay the amount. "I told them I earn Rs 12,000 a month. How can I pay Rs 36 crore?" Jitesh said. "They told me to go to the GST office. I did, but they just passed me around and sent me to the Cyber Crime Department. When I went there, they said it wasn’t their jurisdiction and to go to the police. At the police station, they said, 'This is not our work.' Now, I don’t know where to go."

This bureaucratic runaround has left Jiteshbhai in limbo, with no clear path forward.

Public outrage: The question of fairness

The case has raised several questions about the fairness of the tax department's actions. How is it possible for a man who qualifies for government housing aid to suddenly be held liable for such an enormous sum? Social media is abuzz with comments from citizens questioning the legitimacy of the tax notice and calling for justice for Jiteshbhai and his family.

As the family waits anxiously for any signs of help, many are asking: Is this a case of bureaucratic oversight, or is it a sign of a larger flaw in the tax system? For now, Jiteshbhai and his family are left hoping for a miracle—one that would not only help them avoid financial ruin but also restore their faith in a system that seems to have failed them at every turn.

This strange saga of a Rs 36 crore tax bill, aimed at a family surviving on small wages, highlights the absurdities of bureaucracy and raises larger questions about the accountability of government departments in ensuring justice for the common man. Will the system step in to correct this mistake, or will the Makwanas be left to bear the weight of an impossible demand? Only time will tell.

(Inputs from Mahendra Prasad)