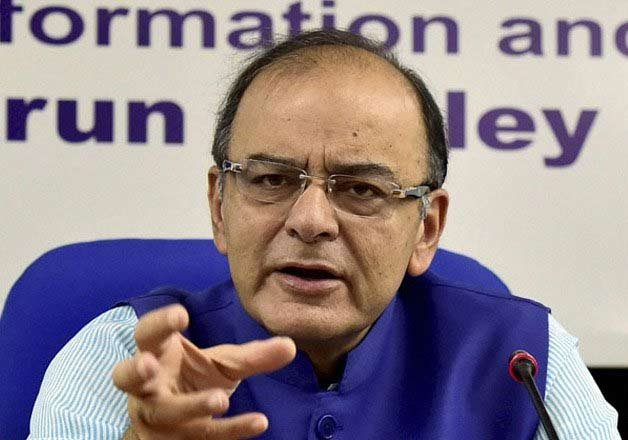

New Delhi: While presenting the General Budget 2016-17 in Lok Sabha here today, the Union Finance Minister Arun Jaitley said that the taxation is a major tool available to Government for removing poverty and inequality and this has to be cautiously exercised.

But, he would like to give relief to small tax payers, the Finance Minister added.

Thus the ceiling of tax rebate under Section 87A of IT Act has been proposed to be raised to Rs. 5,000 from Rs. 2,000 for individuals with income less than Rs. 5 lakhs. He said that above 2 crore tax payers would get a relief of Rs. 3,000. The limit of deduction of house rent paid under section 80GG has also been raised to Rs. 60,000 from the existing Rs. 24,000 per annum to give relief to employees who live in rented houses.

Under the presumptive taxation scheme under Section 44AD of the Income tax Act, the limit of turnover or gross receipts has been raised to two crore rupees from the exiting one crore rupees to benefit about 33 lakh small business people. It frees a large number of such assesses in the MSME category from the burden of maintaining detailed books of account and getting audit done.

The presumptive taxation scheme is to be now extended to professionals with gross receipts up to Rs. 50 lakh with the presumption of profit being 50% of the gross receipts.