To encourage the shift to the new tax regime, the government is repositioning Minimum Alternate Tax (MAT) as a final tax for those who opt in. The announcement was made in the Union Budget 2026-27 and will impact companies that are still under the old tax regime. The MAT rate is reduced from 15 per cent to 14 per cent. Once paid under the new regime, this tax is considered final. There will be no allowance for future tax credits regarding payments made after the shift.

MAT Credit Set-Offs for Domestic Companies

If your company has been sitting on "brought forward" MAT credit, the new rules provide a specific window for utilisation. Set-offs are available to domestic companies that shift to the new regime henceforth.

“It is proposed that the tax paid under the provisions of MAT be made as the final tax in the old regime, and no new MAT credit may be allowed. However, the tax rate of MAT has been reduced to 14% of book profit from the existing 15%. Further, set-off of MAT credit may be allowed only in the new tax regime for domestic companies to the extent of 25% of the tax liability.” Said the Budget Memorandum for FY2026-27.

25 per cent cap

However, for credits brought forward as of April 1, 2026, companies can use them to offset up to 25 per cent of their total tax liability within the new regime.

Also, credits aren’t indefinite. They remain available only until the 15th year after the assessment year in which they were originally generated. The mechanism for foreign entities remains tied to the delta between standard tax and MAT.

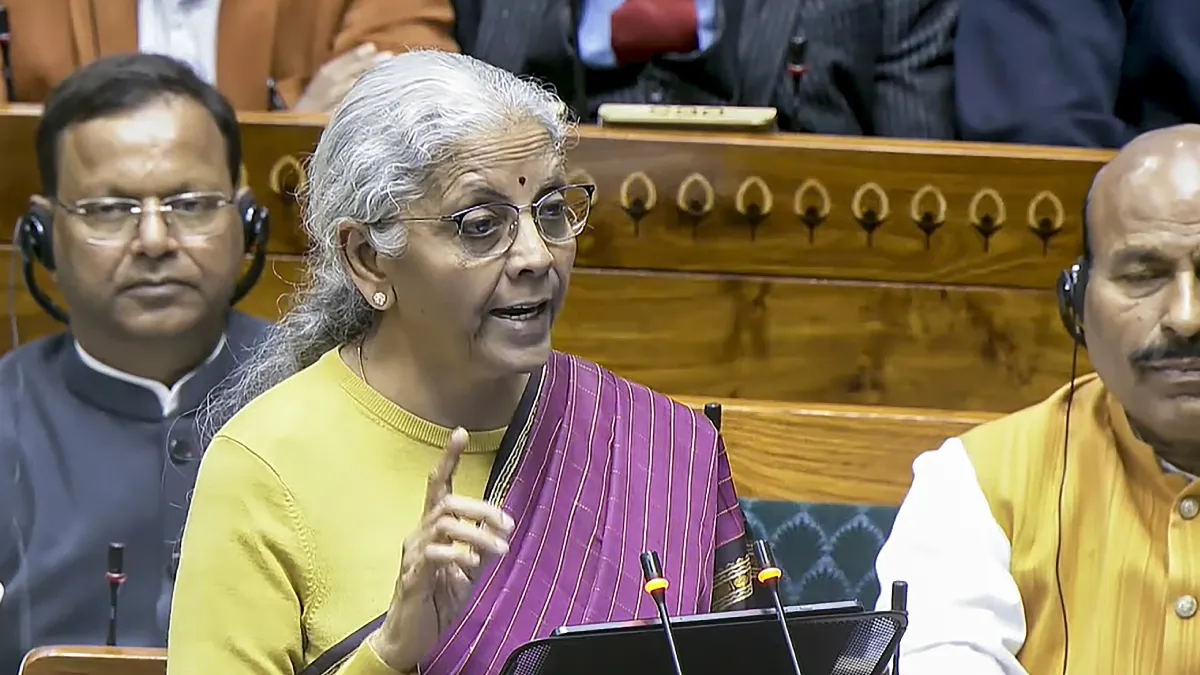

Finance Minister Nirmala Sitharaman's 85-minute speech, described as "historic and futuristic" by Prime Minister Narendra Modi, began with the invocation of Guru Ravidas and the "sacred occasion of Magh Purnima", but maintained a business-like approach throughout.