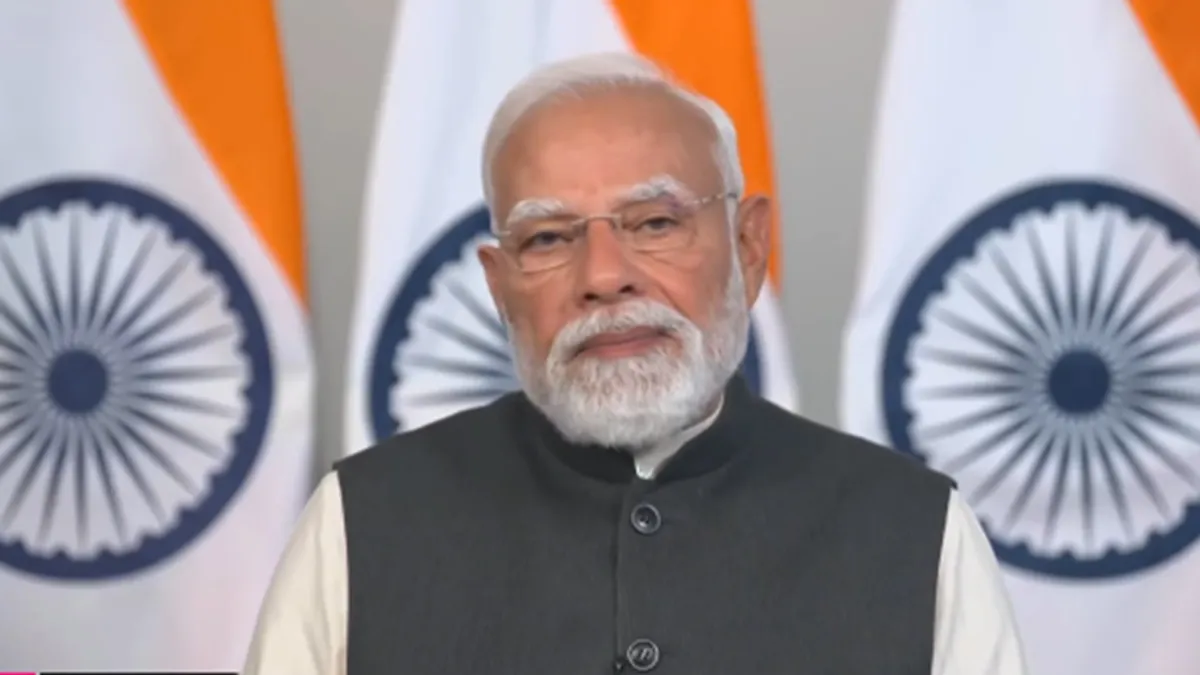

Prime Minister Narendra Modi on Sunday described the Union Budget 2026 as historic, saying it reflects the empowerment of women, accelerates India’s reform journey and lays a strong foundation for the country’s future growth. Praising Finance Minister Nirmala Sitharaman for presenting her ninth consecutive Union Budget, PM Modi said the Budget transforms aspirations into reality and strengthens India’s path towards becoming a developed nation. Calling the moment significant, the Prime Minister said Sitharaman has created history as a woman Finance Minister by presenting the Budget for the ninth time in a row. “Today’s budget is historic. It reflects the strong empowerment of the nation’s women power,” PM Modi said. He added that the Budget acts like a “highway of immense opportunities,” turning present-day ambitions into concrete outcomes.

Roadmap to a developed India by 2047

Emphasising long-term goals, PM Modi said India is not content with being the fastest-growing economy alone. “The 140 crore citizens of India want the country to become the world’s third-largest economy as soon as possible,” he said. According to the Prime Minister, Budget 2026 provides a strong base for India’s “high flight” towards becoming a developed nation by 2047.

“This budget gives new energy and momentum to the reform express on which India is riding today,” he said.

Union Home Minister Amit Shah on Budget 2026

Union Home Minister Amit Shah said the Budget announced on Sunday "turbocharges the momentum" to bolster India's position on the global stage as the most attractive investment destination for a wide range of sectors, from traditional to the new-age ones.

"From manufacturing to infrastructure, from health to tourism, from rural areas to AI, from sports to pilgrimage sites, #ViksitBharatBudget is a budget that empowers the dreams of the youth, women, and farmers of every village, every town, and every city, enabling them to realize those dreams," Shah said in a series of messages on 'X'.

"Through the Budget 2026-27, Prime Minister Modi Ji has proven that Atmanirbhar and Viksit Bharat is not just a slogan, but the resolve of our government. This budget not only provides a clear blueprint for empowering every sector, every class, and every citizen, but also offers a grounded vision to encourage it, which will support it at every step. #ViksitBharatBudget is a vision for building an India that leads in every field in the world," he said.

"This will strengthen the rural economy and provide new support to weavers, farmers and the handloom industry," he said.

Uttar Pradesh CM Yogi on Budget 2026

Uttar Pradesh CM Yogi Adityanath during a press conference, said, "...The world’s largest democracy has further laid out a 'Viksit Bharat roadmap and presented the Union budget today. I thank PM Modi for his leadership and supervision of the budget guidelines. I also thank Finance Minister Nirmala Sitharaman for presenting this budget. This budget reflects the aspirations of 145 crore people in the country and their hopes. It embodies the vision and mission of ‘Viksit Bharat’. Over Rs 12 lakh crore has been provisioned for capital expenditure towards infrastructure development, including provisions for seven rail corridors. The budget places emphasis on AYUSH and the healthcare sector. It also focuses on the common people and is women-centric, too. Overall, the budget covers a wide spectrum of sectors and reforms that will ease the lives of ordinary citizens…”

Focus on ease of living and tax simplicity

Presenting the Budget in Parliament, Union Finance Minister Nirmala Sitharaman announced a series of tax-related measures aimed at simplifying compliance and improving ease of living for citizens. She said the government’s focus is on making the income tax system more citizen-friendly.

Among key announcements, any interest awarded by the Motor Accident Claims Tribunal (MACT) to a natural person will be exempt from income tax. The move is expected to benefit accident victims and their families by ensuring compensation is received without tax deductions.

TCS cuts to ease overseas spending

Sitharaman also announced a significant reduction in Tax Collection at Source (TCS) on overseas tour packages. The TCS rate has been reduced to 2 per cent, down from the earlier 5 per cent and 20 per cent slabs. The reduced rate will apply without any amount-based condition, making foreign travel transactions simpler and less burdensome for taxpayers.

In another simplification measure, the TCS rate for sellers of alcoholic liquor, scrap and minerals has been rationalised to a flat 2 per cent, replacing multiple rates that previously applied to these sectors.

Higher duties on tobacco, changes in trading costs

The Budget also proposes an increase in excise duty and the imposition of a new cess on tobacco products, including cigarettes and pan masala, leading to higher prices. In the alcohol and trading segment, alcohol prices are set to rise, while trading in futures and options (F&O) has become costlier due to an increase in the Securities Transaction Tax (STT).

To promote domestic manufacturing, the government has withdrawn import duty exemptions on certain industrial machinery and products where sufficient manufacturing capacity exists within the country. While the move supports the ‘Make in India’ push, it may raise costs for some industries that relied on cheaper imports.

The Finance Minister also announced a restructuring of the National Calamity Contingent Duty (NCCD) on select tobacco products. From May 1, 2026, the NCCD rate will be raised on paper from 25 per cent to 60 per cent, but without increasing the actual tax burden on manufacturers or consumers. Other components of excise duty will be adjusted to keep the effective duty unchanged.

This technical change applies to products such as chewing tobacco and jarda scented tobacco, offering the government greater flexibility in tax management without impacting prices.