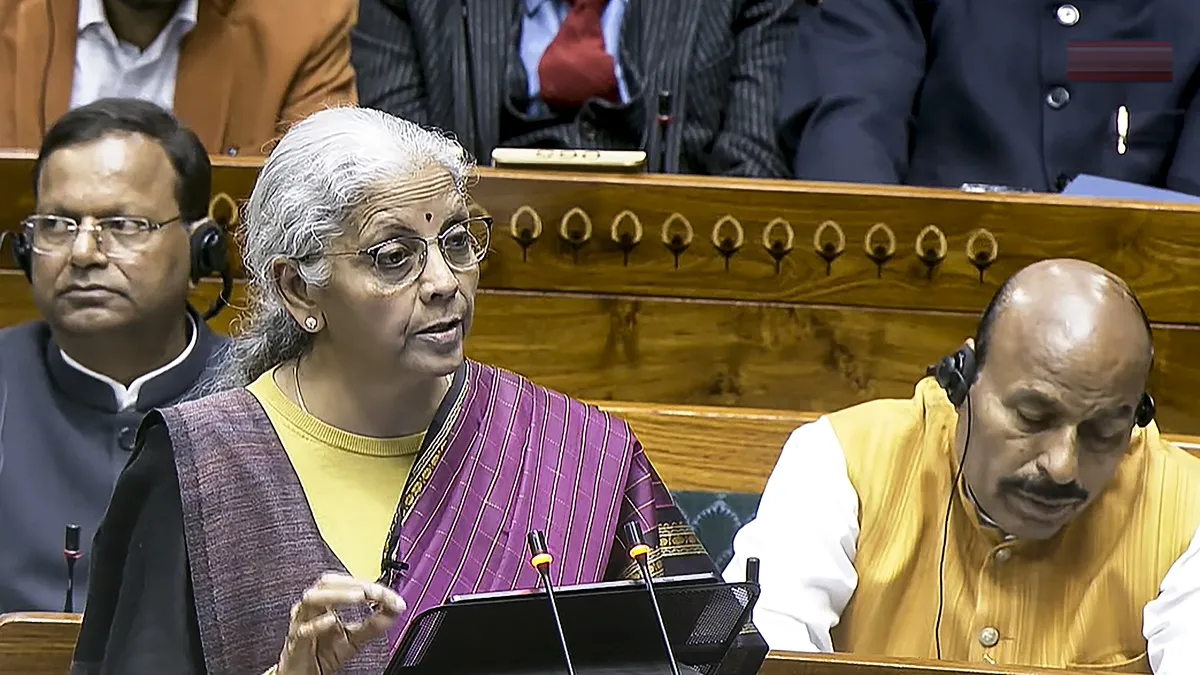

Nirmala Sitharaman, Union Finance Minister, presented her record ninth consecutive Union Budget 2026-27 on February 1, emphasising accelerated economic growth, people's aspirations and inclusive development under three core 'kartavyas.' The budget highlights steady growth with low inflation over the past 12 years, driven by over 350 reforms since 2025, including GST simplification and labour codes, while drawing inspiration from youth ideas shared in the Viksit Bharat Young Leaders Dialogue.

Cancer drugs and health duty exemptions

A major relief for patients, the budget exempts basic customs duty on 17 life-saving drugs and medicines for cancer treatment, alongside adding seven more rare diseases eligible for duty-free imports of drugs, medicines, and special medical foods. This builds on commitments to healthcare accessibility, including adding 1,00,000 allied health professionals over five years and training 1.5 lakh caregivers next year.

Direct tax reforms for taxpayers

Significant income tax simplifications aim to ease compliance and reduce disputes. Interest from Motor Accident Claims Tribunal awards to individuals is now fully income tax-exempt with no TDS; TCS rates drop to 2 per cent for overseas tour packages, education, and medical remittances under LRS. Penalties and prosecutions integrate into single orders, with reduced pre-payment for appeals (10% from 20%), technical defaults as fees, and immunity frameworks for misreporting or small foreign assets under Rs 20 lakh. Small taxpayers gain automated lower/nil TDS certificates, extended return deadlines to August 31 or March 31 with fees, and a one-time foreign asset disclosure scheme offering immunity upon payment.

Khelo India Mission sports overhaul

The budget launches the 'Khelo India Mission' to revolutionise India's sports sector over the next decade through an integrated talent pathway, coach development, sports science integration, competitive leagues, and infrastructure upgrades. This aligns with broader youth empowerment, including 5 University Townships near industrial corridors and girls' hostels in every district.

Defence budget 2026 surge

The Union Budget 2026-27 allocates Rs 7.8 lakh crore to the Defence Ministry, marking a 15% year-on-year increase to strengthen military capabilities.

Modernisation funding boost

Defence forces receive Rs 2.19 lakh crore under Capital Outlay for modernisation, up 21.84% from Rs 1.80 lakh crore in FY25-26. This supports major projects like Rafale fighter jets, submarines, and unmanned aerial vehicles.

Revenue and pension allocations

Defence Services (Revenue) gets Rs 3,65,478.98 crore (17.24% rise), while Defence Pensions rise to Rs 1,71,338.22 crore. Civil defence budget sees a minor 0.45% cut from Rs 28,554.61 crore last year.

Customs duty exemption

Finance Minister Nirmala Sitharaman announced basic customs duty exemption on raw materials for aircraft parts used in defence maintenance, repair, and operations.

Manufacturing and infrastructure boost

Under Kartavya 1 for growth, manufacturing scales in seven sectors: Rs 10,000 crore Biopharma SHAKTI scheme, ISM 2.0 for semiconductors, Rs 40,000 crore for electronics, Rare Earth Corridors in four states, three Chemical Parks, Hi-Tech Tool Rooms, and a five-part textile program with Mahatma Gandhi Gram Swaraj. Public capex hits a record Rs 12.2 lakh crore (4.4% GDP effective capex), with Rs 1.85 lakh crore state assistance up 23% YoY.

Orange Economy initiative

Union Finance Minister Nirmala Sitharaman proposed robust support for India's creative industries, termed the 'Orange Economy,' to foster future-ready jobs in content creation.

AVGC content creator labs

She announced support for the Indian Institute of Creative Technologies, Mumbai, to establish AVGC (Animation, Visual Effects, Gaming, Comics) Content Creator Labs in 15,000 secondary schools and 500 colleges.

Job creation potential

This targets the rapidly growing AVGC sector, projected to need 2 million professionals by 2030, powering jobs, startups, and aligning with Economic Survey 2025-26 emphasis on creativity-led sectors like media, entertainment, and IP for employment and tourism growth.

Farmer incomes and regional focus

Kartavya 3 targets inclusive access: 500 reservoirs for fisheries, high-value crops like coconut and cashew, AI tool Bharat-VISTAAR, and SHE-Marts for rural women. Purvodaya states gain an East Coast Industrial Corridor, tourism sites, and Buddhist circuits in the Northeast.

Fiscal discipline maintained

Fiscal deficit stays at 4.4% GDP for FY26 RE, on track below 4.5% glide path. Indirect tax eases living with 10% tariff on personal imports (from 20%), revised baggage rules, and export boosts like duty-free fish catch and e-commerce cap removal. This "Sabka Saath, Sabka Vikas" budget positions India for Viksit Bharat by 2047 through productivity, resilience, and opportunity for all.