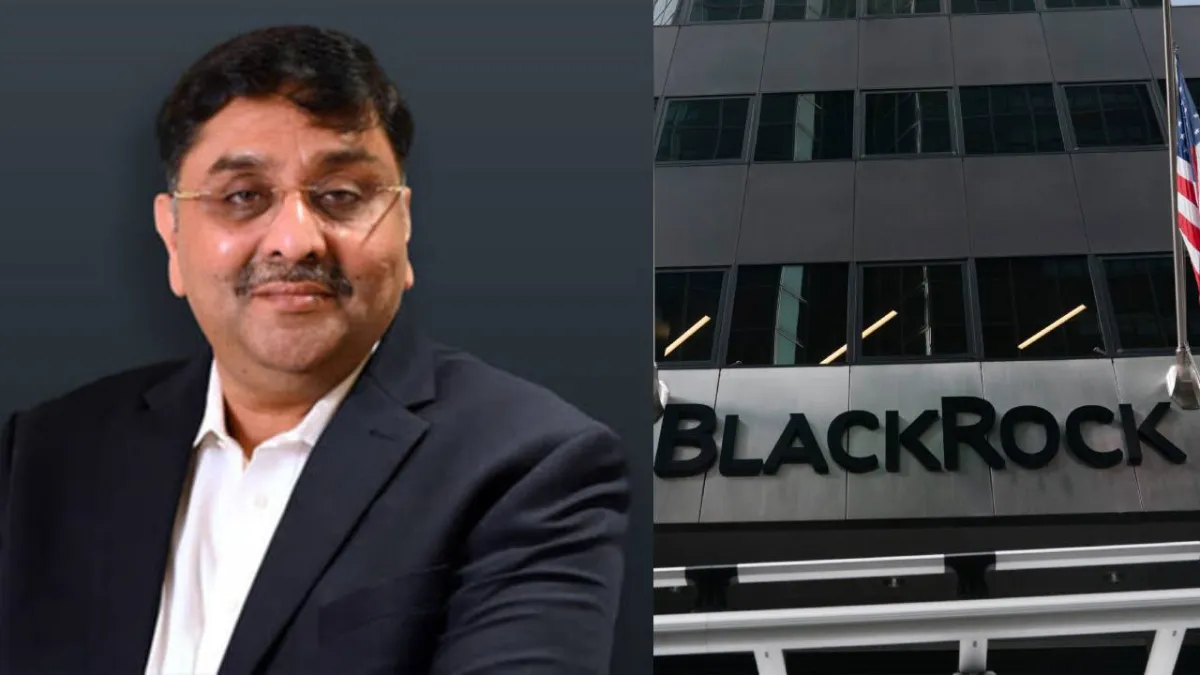

Bankim Brahmbhatt, a US-based telecom entrepreneur of Indian origin, has been accused of operating a large scale loan fraud worth more than USD 500 million by raising money through fake invoices and bankrupt firms, according to a report by The Wall Street Journal.

What is the BlackRock fraud case?

Brahmbhatt, who owns Broadband Telecom and Bridgevoice, is alleged to have created fake customer accounts and fabricated receivables to secure substantial loans from American lenders. Among the affected lenders is HPS Investment Partners, an investment firm backed by BlackRock, one of the worlds largest asset management companies.

According to the report, lenders filed a lawsuit in August, claiming Brahmbhatt misled them by pledging revenue streams that did not exist as collateral. His companies have since entered Chapter 11 bankruptcy proceedings and now owe more than half a billion dollars.

How Bankim Brahmbhatt secured loans

The loans were arranged with the involvement of BNP Paribas, which worked with HPS to provide financing to Brahmbhatt's telecom ventures. HPS began lending money to one of his companies in September 2020 and increased the exposure to USD 385 million by early 2021 and to USD 430 million by August 2024. Sources told the WSJ that BNP Paribas supplied nearly half of the funds through two HPS credit funds.

The case has renewed concerns about the rapidly expanding private credit market, where loans are often backed by projected revenues or business assets. Experts note that similar cases have surfaced recently, including those involving First Brands and the Tricolor auto dealer chain, both of which entered bankruptcy after allegedly misusing this type of financing.

Brahmbhatt filed for personal bankruptcy on August 12, the same day his companies sought Chapter 11 protection. Chapter 11 allows businesses to continue operating while negotiating repayment terms with creditors.

When WSJ reporters visited his listed office in Garden City, New York, they found it shut and empty. Nearby tenants said the office had been unoccupied for weeks. A visit to a residential address associated with him also went unanswered.

Bankim Brahmbhatt now missing

Sources told the WSJ that HPS is concerned Brahmbhatt may have left the United States for India. However, his lawyer has denied the allegations, stating that the claims in the lawsuit are without merit.

The case has brought renewed focus to the risks in private lending, where investors seeking high returns may approve loans without full clarity on how the money is being used.

Also read: US takes dig at India in new ad claiming H1B visa 'abuse'