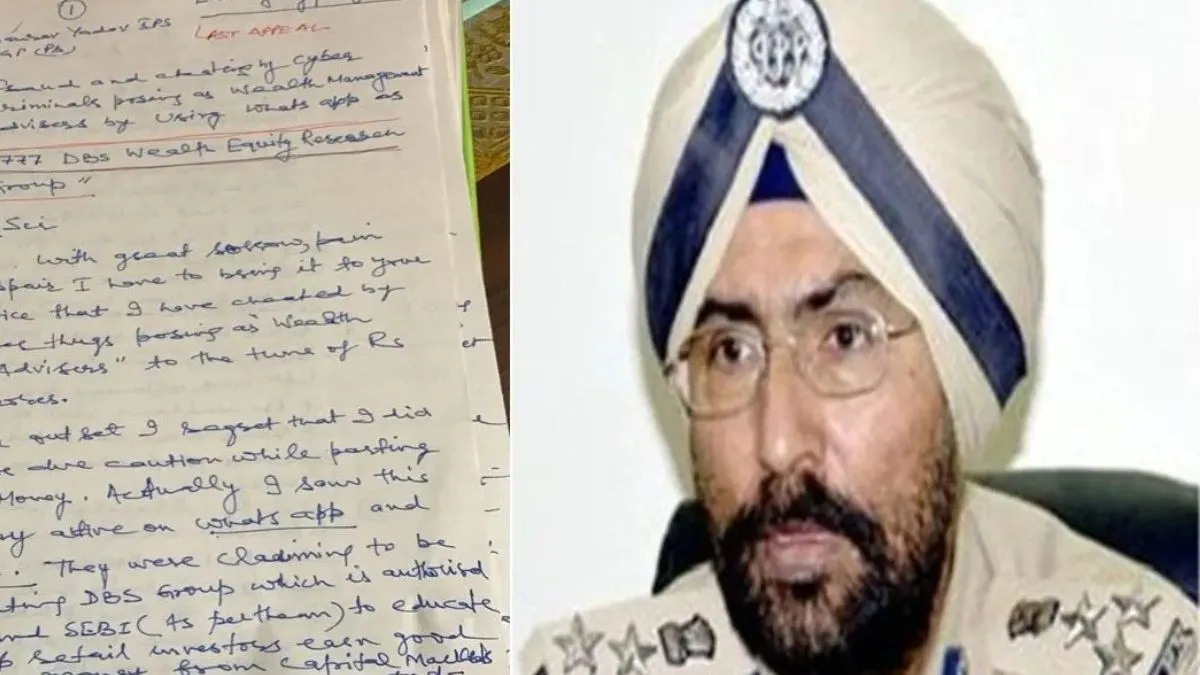

The purported suicide note written by Former Punjab IPS officer Amar Singh Chahal who reportedly attempted suicide by shooting himself is doing rounds in social media. Chahal allegedly shot himself in a purported note, he claimed that he had been duped of Rs 8.10 crore by cyber thugs who posed as wealth management advisors.

Amar Singh had submitted a 12-page note addressed to the DGP, in which he directly described himself as a victim of an online fraud involving Rs 8.10 crore. In this 12-page note, he detailed:

- He was cheated under the pretext of investment.

- The fraudsters posed as wealth equity advisors to take his money.

- The scammer claimed to be the CEO of DBS Bank.

- He was lured with promises of profits from IPO and OTC trades.

- He transferred over ₹8 crore through three bank accounts.

- The profits shown on the dashboard were fake.

- Extortion began when he tried to withdraw money.

No one knew about the fraud

Friends of Amar Singh said that no one knew about this fraud. According to his note, harassment and extortion started after he attempted to withdraw the invested money. When he tried to withdraw Rs 5 crore, scammers took Rs 2.25 crore in the name of a 1.5% service fee and 3% tax. Even after this, the money was not released, and another Rs 2 crore was demanded. Later, Rs 20 lakh was asked as a premium membership fee. Neither his close ones nor his neighbors were aware of the fraud, and even his family had no knowledge of it.

In his note, Amar Singh also described how the scammers trapped him:

- One person claimed to be DBS CEO Dr. Rajat Verma and started giving daily tips related to the stock market, IPOs, and trading.

- The CEO photo in the profile increased investor trust

- Questions could be asked in the group, but answers were given immediately.

- Later, investors were shown an online dashboard detailing four types of schemes: Daily Trade Stocks, OTC Trade, IPO, and Quantitative Funds.

- Each scheme showed returns higher than previous ones.

- The group claimed DBS Group received shares at discounted IPO rates.

- OTC trades showed 30–40% returns and Quantitative Funds showed over 50% returns.

- Over Rs 8 crore was transferred through three bank accounts.

According to the note, the scammers trapped Amar Singh in such a way that he could not withdraw his money. The three accounts used were with Axis, HDFC, and ICICI banks, of which Rs 7 crore were borrowed funds. Amar Singh included bank details, IFSC codes, and transaction records in the note.

With inputs from Indrapal Singh