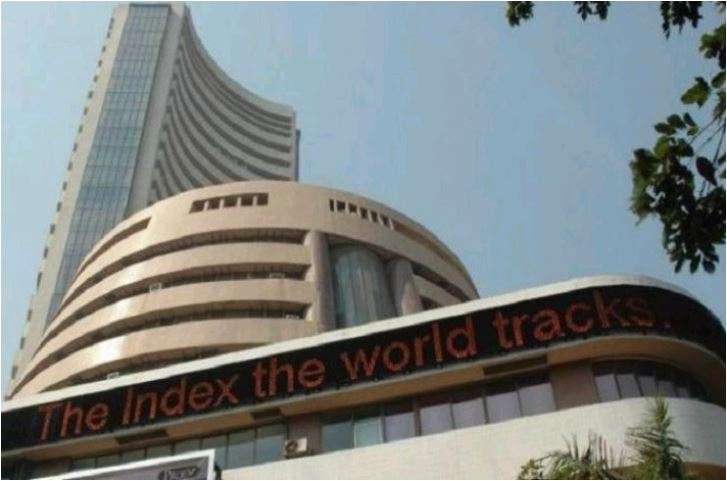

The BSE Sensex snapped its three-session rising streak to close 189 points lower on Wednesday, led by losses in metals, energy, banking and auto counters, as global markets wobbled amid recession fears.

Profit-booking following the recent rally and a depreciating rupee also weighed on bourses, traders said.

Additionally, India Ratings lowered the country's growth forecast to a six-year low of 6.7 per cent for the current fiscal from its earlier estimate of 7.3 per cent on account of slowdown in consumption and moderation in industrial growth, among other factors.

After a choppy session, the 30-share Sensex settled 189.43 points, or 0.50 per cent, lower at 37,451.84. Similarly, the broader NSE Nifty fell 59.25 points, or 0.53 per cent, to 11,046.10.

Global equities were held back by fears of an impending recession following the latest inversion of yield curves of US Treasury bonds -- seen as a predictor of economic contraction.

Yes Bank was the biggest loser in the Sensex pack, plunging 7.47 per cent, after Moody's Investors Service downgraded the lender's long-term foreign-currency issuer rating, terming the bank's outlook as negative.

Vedanta, Tata Steel, Tata Motors, ONGC, M&M, Maruti, NTPC and HUL too fell up to 4.06 per cent.

On the other hand, HCL Tech, Infosys, Tech Mahindra, HDFC, TCS and Asian Paints rose up to 2.61 per cent.

"Despite reversal in surcharge, FPIs continued to be net sellers due to clouds over global trade discrepancies, risk of recession and fall in bond yields, which are having a ripple effect on the market. Consensus estimate a drop in domestic Q1FY20 GDP growth to 5.7 per cent and weakening rupee impacted investors' optimism on earnings outlook," said Vinod Nair, Head of Research, Geojit Financial Services.

Sectorally, the BSE metal, auto, power, utilities, bankex, industrials, energy and finance indices tumbled up to 3.40 per cent.

Realty, IT and teck indices settled up to 1.86 per cent higher.

The broader BSE midcap and smallcap indices too ended 0.92 per cent lower.

Elsewhere in Asia, Shanghai Composite Index and Hang Seng ended in the red, while Kospi and Nikkei settled on a positive note.

Equities in Europe were trading in the negative zone in their respective early sessions.

Meanwhile, the Indian rupee depreciated 27 paise to 71.75 against the US dollar intra-day.

Brent crude futures, the global oil benchmark, rose 1.07 per cent to USD 59.66 per barrel.

Also Read | Airtel Africa crosses 100 million subscribers base

Also Read | Moody's downgrades Yes Bank's long-term foreign currency issuer rating