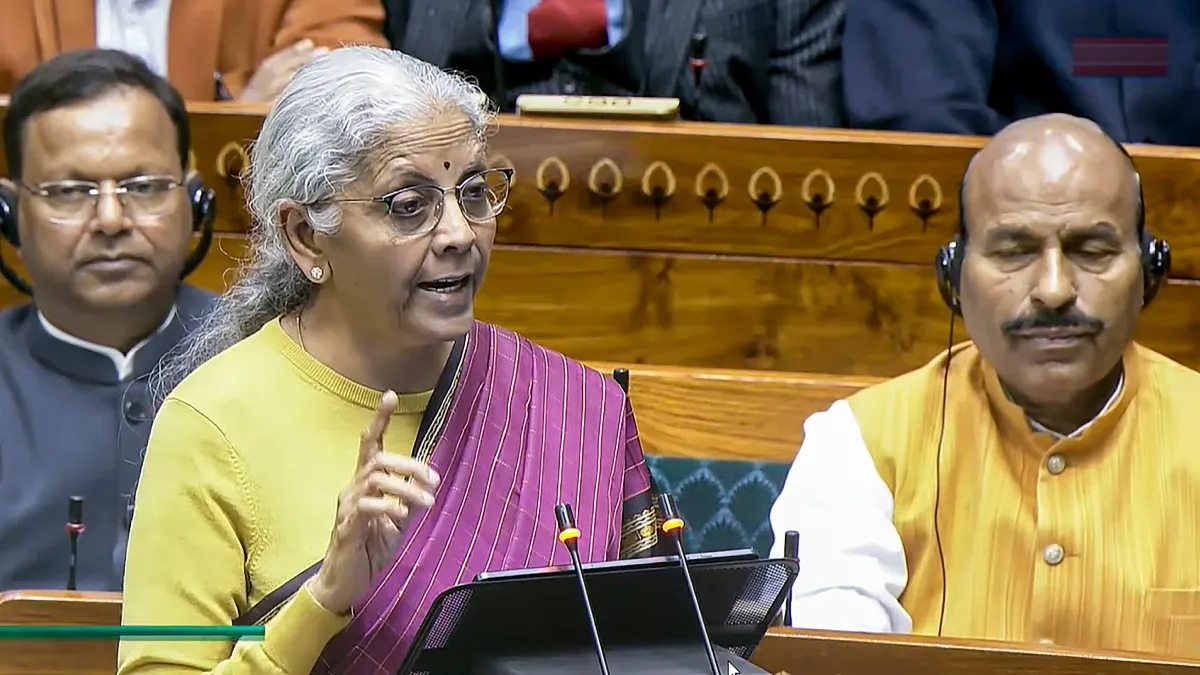

In the Union Budget 2026-27, Finance Minister Nirmala Sitharaman has announced that the rate of Tax Collected at Source (TCS) applicable to sellers of alcoholic liquor, scrap and minerals has been simplified to a flat rate of 2 percent. Prior to this, sellers in these sectors were required to pay different rates of TCS, which in some cases were higher.

Alcohol, Scrap & Minerals: TCS rate rationalised to 2% for sellers

The prices of tobacco products like cigarettes, pan masala, and other similar products have increased due to an increase in excise duty and the imposition of a new cess. In the alcohol and trading category, the prices of alcohol have increased, but trading in futures and options (F&O) has become costlier due to an increase in the Securities Transaction Tax (STT).

Exemptions on import duties have also been revoked for some industrial machinery and products for which the country's manufacturing capacity is found to be adequate. This is a step towards promoting manufacturing in the country, but it may increase costs for some industries that imported such products at a lower cost.

NCCD rate revised on tobacco products without increasing effective tax burden

This amendment provides that the National Calamity Contingent Duty (NCCD) on specific tobacco products will be changed on paper from 25 percent to 60 percent from May 1, 2026, but without any change in the actual tax incidence paid by the manufacturers or consumers.

In simple words, while the rate of NCCD is being hiked, the government will reduce other elements of excise duty to keep the same effective duty. This is more of a technical change, which is often made to give the government flexibility in managing taxes without impacting prices.

This change will be applicable to chewing tobacco, jarda scented tobacco, and other similar tobacco products.

Also Read: Budget 2026: New Income Tax Act 2025 will come into effect on April 1, says Sitharaman