With less than a fortnight to go for the Union Budget 2018, predictions and expectations are at full face. Several industry representatives, institutes and economists have come up with their pre-budget memorandum, with the hope that expectations will get converted into reality.

Why this budget is crucial for the Modi government is because it comes after the implementation of two major structural reforms – demonetization and Goods and Services Tax (GST), which have attracted equal criticism as appreciation from various sections.

Also, it hold importance as it comes ahead of the 2019 general elections and in a year when state assemblies – Meghalaya, Tripura, Mizoram, Nagaland, Karnataka, Madhya Pradesh, Chhattisgarh and Rajasthan – go to polls.

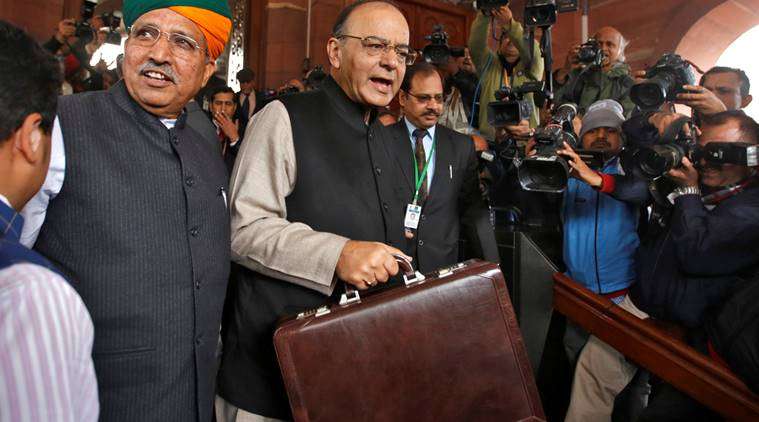

While what comes out of Arun Jaitley’s briefcase remains suspense till February 1, here is what the common man expects from the upcoming budget.

Rise in tax exemption limit to woo the common man

In a big relief to the common man, the finance ministry is contemplating to hike personal tax exemption limit and tweak the tax slabs.

According to government sources, the proposals before the finance ministry is to hike the tax exemption limit from the existing Rs 2.5 lakh per annum to at least Rs 3 lakh.

Besides, the tinkering of tax slab is also being actively considered by the ministry to give substantial relief to middle-income group, especially the salaried class, to help them tide over the impact of retail inflation, which has started inching up.

In the last Budget, Finance Minister Arun Jaitley left the slabs unchanged but gave marginal relief to small tax payer by reducing the rate from 10 per cent to 5 per cent for individuals having annual income between Rs 2.5-5 lakh.

In the next Budget to be unveiled on February 1, the government could lower tax rate by 10 per cent on income between 5-10 lakh, levy 20 per cent rate for income between Rs 10-20 lakh and 30 per cent for income beyond Rs 20 lakh.

An increase in the tax exemption limit would mean more disposable income in the hands of taxpayers. Hence, a spur in demand of goods and spending will eventually boost the economic growth.

As per Industry body FICCI, the government should consider revising the income tax slabs by raising the upper limit for peak tax rate which will help balance the impact of demonetization by boosting demand.

Also, the government may re-introduce standard deduction for salaried individuals. The industry bodies have suggested giving standard deduction of at least Rs 1 lakh on salary in Union Budget 2018 to ease tax burden and give salaried employees more money in hand to deal with rising inflation. Standard deduction on salary was done away with in 2006-07.

Agriculture to be government’s top priority to deal with farm distress

According to the latest data from the Central Statistics Office (CSO), the country’s economic growth is expected to slow down to a four-year low of 6.5 per cent in FY18, the lowest under the Modi government, mainly due to the poor performance of agriculture and manufacturing sectors.

The CSO has pegged farm and allied sector growth to slow to 2.1 per cent in the current fiscal year from 4.9 per cent in the preceding year.

The Gujarat elections highlighted that BJP’s overall performance was better in urban than in rural regions. There are concerns that farmer distress due to low prices of agriculture produce is likely to weigh on electoral outcomes in the 2019 Lok Sabha polls.

Last year, farmers protested over multiple agriculture-related issues including crop loan waiver and plummeting crop prices in Madhya Pradesh, Gujarat, Uttar Pradesh and other parts of the country. Also, there have been instances of farmers death while they protested over minimum support for their farm produce.

It is likely that the budget would be focused on rural population and farmers. Most analysts said it is likely that the government will further enhance its focus on spending towards agriculture and rural themes.

Jaitley recently said that the agriculture sector was the top priority for the government because the country’s economic growth is not “justifiable and equitable” unless the benefits are “clear and evident” in the farm sector.

He said that the government’s priority is to ensure that the gains reach the farmers and the growth is visible even in the farm sector.

The government is likely to increase the budget allocation for farm education, research and extension by up to 15 per cent to around Rs 8,000 crore in 2018-19 fiscal as focus will on making rapid strides in doubling farmers' income, one of BJP’s top poll promises before the 2014 general elections and 2017 Uttar Pradesh Assembly polls.

Also, the agricultural experts have asked for an Income Security Act in the upcoming budget session.

The Pradhan Mantri Fasal Bima Yojana (FMFBY) provides an insurance cover to crops for struggling farmers. However, there is a further need to cover assets like households, cattle etc., which belong to farmers.

Infrastructure sector to get another big push

The infrastructure push has been a major target for the Modi government through all four budgets. “Our infrastructure does not match our growth ambitions. There is a pressing need to increase public investment,” Arun Jaitley had said in 2015.

In 2017 budget, the government had allocated a record Rs 3.96 lakh crore to the infrastructure sector to spur economic activities and create more jobs.

The massive push is likely to continue with the infrastructure sector being on agenda in the upcoming budget as well. As this is going to be the last full-fledged Budget of the government before the 2019 general elections, investment in infrastructure sector is going to serve a dual purpose – development and job creation.

Economic Affairs Secretary Subhash Garg recently said that the government is planning to dedicate a large part of budget towards capital expenditure on infrastructure and will push for foreign investments in the sector.

Arun Jaitley had said that while highways and ports have shown satisfactory results, infrastructure development in railways needs to be hurried.

There are at least 10 big infrastructure projects in the pipeline including Rs 12 lakh crore Sagarmala project and Rs 14,000 crore Bharatmala project. Moreover, the ambitious Bullet Train project will need at least Rs 1.1 lakh crore of investment during the 2017-22 period.

Meanwhile, the government is also pegging Rs 20 lakh crore investment plan for high-speed corridors and other projects for the modernisation.

On the other hand, the realty sector – severely impacted by various reforms such as RERA, GST and demonetization – is pinning its hopes for relief measures like lower taxes and infrastructure status.

The year 2017 was an eventful one for the sector with many structural policy reforms, which resulted in a significant decline in home launches to 1,03,570 units compared to 1,75,822 in 2016.

Industry players are expecting rationalisation of the GST rates from the current 12 per cent to 6 per cent and bringing stamp duty under the ambit of GST.

Also, industry status to the full real estate sector will help in creating surplus housing demand along with financing at lower rate for long-term projects.

The industry is also expecting certain tax sops to homebuyers like increasing the Rs 2 lakh tax deduction limit for housing loans, and tax incentives for first-time home buyers hiked from Rs 50,000 to Rs 2 lakh.

Increase in healthcare outlay

According to a report by rating agency ICRA, public sector accounts for only 30 per cent of the total healthcare expenditure in the country and investment in building and maintaining public health infrastructure needs priority in the upcoming budget.

Public sector investment on healthcare accounts for less than 1.5 per cent of GDP, which is one of the lowest globally, and the government intends to increase the expenditure to 2.5 per cent of GDP by 2025. The outlay on healthcare increased by a healthy 28 per cent in the last budget and the allocation is likely to see a similar increase in the forthcoming budget as well, according to the report.

In line with National Health Policy (NHP) 2017, the expenditure is expected to be directed towards setting up of new hospitals to increase the number of beds in the country, and for transformation of existing district and town level health centres to provide better healthcare facilities across geographies while using the existing infrastructure.

Public sector accounts for only 30 per cent of the total healthcare expenditure in the country, as compared to 42-58 per cent in Brazil, 58 per cent in China, 52 per cent in Russia, 50 per cent in South Africa, 48 per cent in USA and 83 per cent in UK as per the WHO reports.

ICRA believes that investing in building and maintaining public health infrastructure should be given priority in the budget as these facilities are lagging and vast majority of the population has to bear their own healthcare costs due to low penetration of health insurance.

The budget is also likely to increase the allocation for addressing the increasing burden of non-communicable diseases (NCDs) such as diabetes, cardiovascular diseases, hypertension and to increase the outlay for providing free drugs, diagnostics and emergency services across all public hospitals, in line with NHP 2017.

Also, the budget is hoped to allocate funds for more early diagnosis and primary health centers and equipping them adequately.

Safeguarding women’s interests

Keeping in view the considerable spike in crime against women, they are also expecting more funds to be allocated for their security.

“In the previous Budget, the government announced the Nirbhaya funds for the safety of the women, but still the situation remains unchanged. This happened maybe because the funds were not properly utilized or due to lack of proper planning, I expect the government to allocate more funds this time in the upcoming Budget,” a housewife from Nagpur was quoted by news agency ANI as saying.

Levying of 12 per cent GST on sanitary napkins has been challenged by many in India.

Recently, in Madhya Pradesh, hundreds of women from all age groups penned down their messages on sanitary napkins to voice their dissent against the imposition of GST.

Several women welfare organisations and NGOs have pitched for removing GST imposed on sanitary napkins so that more and more women could afford it.

Also, women expect some tax rebate and increase in the number of job opportunity for them in all sectors.