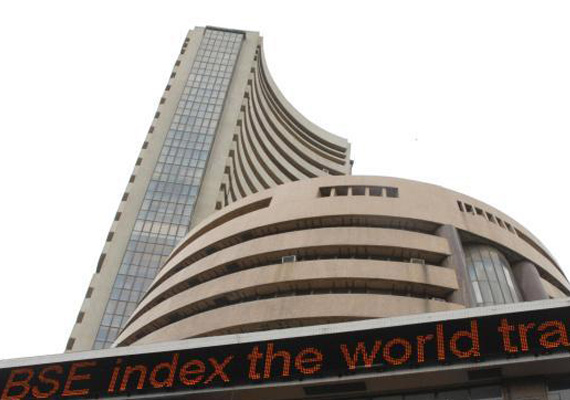

Mumbai, Sep 13: Rising for the seventh straight day today, the Sensex edged up 21 points to close at 18,021.16, a seven-month high, amid investors awaiting the outcome of US Fed meet and monthly inflation data.

After closing above 18,000 mark yesterday, the BSE benchmark index opened marginally higher but trading remained range-bound between 17,976.28 and 18,062.68.

The Sensex finally closed at 18,021.16, up 21.13 points compared to yesterday's closing. The index has added 707.82 points or 4.08 per cent in the seven-day rally.

Hero MotoCorp which gained 1.87 per cent, led the 19 gainers in the 30-share Sensex today. Bhel, HUL, Bajaj Auto and ICICI Bank were among the other gainers.

Shares of Bharti Airtel that slumped 2.85 per cent and Cipla that lost 2.44 per cent, dragged down the index.

“It was a quiet day on the bourses ahead of two critical events. The outcome of US FOMC will be out today and secondly, inflation numbers will be declared in India tomorrow,” said Nagji K Rita, CMD, Inventure Growth & Securities.

The 50-share National Stock Exchange index Nifty rose by 4.35 points, or 0.08 per cent, to 5,435.35.

Brokers said expectations are building up that US Fed will once again announce a monetary easing program, which will add liquidity to the system and eventually give a boost to stocks.

Market participants also appeared enthused by comments of Cabinet Secretary Ajit Seth who in Delhi said several policy measures are on the anvil (to prop up the investment climate).

The RBI meeting on September 17 could be the real driver for the market now, said Kishor P Ostwal, CMD, CNI Research.

The BSE FMCG sector index gained the most by rising 0.58 per cent to 5,433.46 points, followed by BSE Oil and Gas sector by 0.44 per cent to 8,473.25 points.

Oil & gas counters including BPCL, ONGC, IOC and HPCL closed higher ahead of a fuel price hike decision likely to be taken in the Cabinet Committee on Political Affairs (CCPA) meeting that will be held later in the day.

Asian stocks ended mostly higher today ahead of the US policy meeting with investors remaining cautiously optimistic on further stimulus action to bolster the world's largest economy.

Key benchmark indices in Japan, South Korea, Singapore and Taiwan were up between 0.02-0.39 per cent while indices in China, Hong Kong and Indonesia were down by 0.14-0.76 per cent.

However, European stocks were trading lower in the early trade after reaching a 14-month high yesterday. Key benchmark indices in UK, Germany and France were down by between 0.12-0.66 per cent.

In the Indian market, major gainers from the Sensex were Hero Motocorp (1.87 pc), BHEL (1.57 pc), Hind Unilever (1.18 pc), ONGC (1.16 pc), Bajaj Auto (1.15 pc) and ICICI Bank (1.02 pc).

Bharti Airtel, however, dropped by 2.85 per cent, followed by Cipla (2.44 pc), Tata Motors (1.41 pc) and Jindal Steel (1.27 pc).

Among the sectoral indices, the BSE-FMCG moved up by 0.58 per cent, followed by the BSE-PSU (0.55 pc), the BSE-Oil&Gas (0.44 pc) and the BSE-Capital Goods (0.43 pc) while BSE-Healthcare fell by 1.15 per cent, the BSE-Realty (0.53 pc) and the BSE-Auto (0.37 pc).

The total market breadth turned negative as 1,591 shares settled lower while 1,258 finished higher.

The total turnover fell to Rs 1,938.40 crore from Rs 2,412.85 crore yesterday.

Foreign Institutional Investors (FIIs) bought shares worth a net Rs 451.19 crore yesterday as per the provisional data from the stock exchanges.