The Budget presented by the Narendra Modi led government came riding on high hopes from the common man who bore the brunt of the government’s demonetisation move and the government did appear to have this in mind in its roadmap for the coming year.

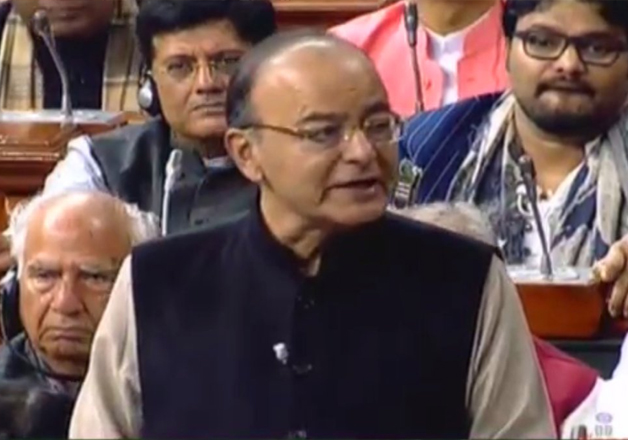

Union Finance Minister Arun Jaitley today announced several tax sops including a cut in the Income Tax rate to 5 per cent from the prevailing 10 per cent for individuals having income between Rs 2.5 lakh to Rs 5 lakh.

Presenting his fourth Budget, Jaitley, however, announced a 10 per cent surcharge on individuals with an income between Rs 50 lakh and Rs 1 crore..

For those in 20 per cent (Rs 5 lakh-Rs 10 lakh) and 30 per cent (Rs 10 lakh plus) tax bracket, there will a Rs 12,500 rebate across the board, Jaitley said, adding that the 15 per cent surcharge on income above Rs 1 crore will continue.

Observing that India was by and large a non-tax compliant country, Jaitley informed the house that of the 3.7 crore individuals who filed tax returns in 2015-16, 99 lakh showed income below exemption limit.

The Finance Minister also announced a reduction in tax rates for small and medium sized companies as part of an earlier promise to gradually reduce these corporate tax rates and phasing out of exemptions given to companies. The tax rate for companies with an annual turnover of upto Rs 50 crore has been brought down to 25% from 30%. This will benefit 96% of the companies, Jaitley said.

Jaitley also lauded the government’s decision on demonetisation, saying that it has long-term benefits and will create an economy that is bigger and cleaner.

"The pace of remonetisation has also picked up and will soon reach comfortable levels. The effects of demonetisation are not expected to spill over to the next year," he said.

He hoped all issues pertaining to the Goods and Services Tax (GST) will be resolved soon. "GST and demonetisation are 'tectonic' changes for the economy," he said.

For Railways, he announced that national transport system will get Rs 1,31,000 crore for capex and development expenditure in 2017-18.

A Railway Safety Fund of Rs 1 lakh crore will be created over a period of five years, he said. The Finance Minister said that Railways will eliminate all the unmanned level crossings by 2020.

The Finance Minister also announced to waive off service charges on Railway e-tickets.

For the defence sector, Jaitley allocated Rs 2,74,114 crore for defence, excluding pensions. "For defence expenditure excluding pensions, I have provided a sum of Rs 2,74,114 crore including Rs 86,488 crore for defence capital," Jaitley said delivering his Budget speech for financial year 2017-18.

To reduce the grievances of defence pensioners, Jaitley announced creation of web based interactive pension distribution system for defence pensioners. Also to end the hassle of booking railway tickets for service personnel, the Minister announced an online tickets booking system.

Further, he stressed the need for greater transparency in political funding. Jaitley said that the maximum amount of cash donation by an individual to a political party will be Rs 2,000 -- a sharp drop from the Rs 20,000 amount in cash earlier.

He said as an additional step, the government proposes to amend the RBI Act for issuing electoral bonds. He said that donors can purchase the bonds through cheques and these will be redeemable in the registered account of a political party.

This was the first time the date of presentation was advanced by nearly a month, even as it co-opts the Railway Budget into it, abandoning the practice that was started in 1924.

Highlights:

* 15 pc surcharge on income above Rs 1 cr to continue

* 10 pc surcharge on individual income above Rs 50 lakh and upto Rs 1 cr to make up for Rs 15,000 cr loss of due to cut in personal I-T rate

* For those in 20 percent (Rs 5 lakh-Rs 10 lakh) and 30 percent (Rs 10 lakh plus), there is a Rs 12,500 rebate

Income Tax rate cut to 5 pc for individuals having income between Rs 2.5 lakh to Rs 5 lakh

* Of 3.7 cr individuals who filed tax returns in 2015-16, 99 lakh showed income below exemption limit

* Direct tax collection not commensurate with income and expenditure pattern

* Cash donations to political parties from a single source capped at Rs 2000: FM Jaitley

* Political parties will be entitled to receive donations by cheque or digital mode: FM Jaitley

* Duty exempted on various POS machines and iris readers to encourage digital payments

* Rs 7,200 cr revenue loss due to reduction in tax on smaller companies

* SIT for black money has suggested that no transaction above Rs 3 lakh to be accepted in cash. The government has accepted the proposal: FM

* Capital Gains Tax holding period reduced from 3 years to 2 years for real estate: FM

* Companies with annual turnover of less than Rs 50 crores, the Income Tax will be 25%: FM

* In order to promote Make in India, I propose to tweak custom duties for imported products as outlined in the Budget document. This will also take care of inverted duties to an extent: FM

* Propose to allow carry forward of MAT to 15 years from 10 years now: FM Jaitley

* The net tax revenue grew by 17% in 2015-16, says Jaitley

* Small and Medium enterprises (MSME) to be encouraged. Income tax reduced to 25% from 30%. The FM says about 96 percent of all MSMEs will be benefited from this move.

* Size of affordable housing carpet area extended. Holding period for gain from immovable property reduced to 2 years from 3 years: FM Jaitley

* New ETF with diverse stocks will be launched in 2017-18: FM.

* After demonetisation on Nov 8 last year, deposit of between Rs 2 lakh and Rs 80 lakh made in 1.09 cr bank accounts at an average of Rs 5.03 lakh till Dec 30

* Over Rs 80 lakh deposits in 1.48 lakh cr at an average of Rs 3.31 cr per account

* Govt doubles distribution target under Mudra Yojana to Rs 2.44 lakh crore for 2017-18

* Govt to introduce two new schemes to promote BHIM App - referal bonus for users and cash back for traders

* Capital gains tax to be exempted, for persons holding land from which land was pooled for creation of state capital of Telangana: FM

* Amount of above Rs 80 lakh was depoitsed in 1.48 lakh bank accounts, an average of Rs 3.13 crore per account

* After demonetisation, deposits between Rs 2 lakh and Rs 80 lakh was made in crore 1.09 bank accounts, on an average of Rs 5.03 lakh per account

* Advance tax on personal Income tax increased by 34.8% due to demonetisation: FM

* We are committed to making our tax rates more reasonable and the tax administration more efficient: FM

* 13.94 lakh companies registered, 5.97 lakh file tax returns, 2.7 lakh companies declared losses: FM

* Of 76 lakh individuals who reported income of over Rs 5 lakh, 56 lakh are salaried

* Urgent need to protect poor from chit fund schemes, draft bill placed in public domain. Govt will amend the Multi-state Cooperative Act to protect the poor and gullible investors

* Only 1.72 lakh people show income above Rs 50 lakh: FM

* Of the 3.5 crore individuals who filed tax returns, 99 lakh showed income below income tax slab, while only 24 lakh show income above Rs 10 lakh: FM Jaitley

* We are largely a tax non compliance society, when too many people evade taxes burden falls on those who are honest: FM Jaitley

* Over 90 per cent of FDI proposls are now processed through automatic route

* Government to further liberalise FDI policy: FM

Rs 2,74,114 crore allocated for defence expenditure, excluding pension.This includes Rs 86,000 crore for defence capital

* Dispute resolution in infrastructure projects in PPP mode will be institutionalised

Govt pegs fiscal deficit target at 3.2 per cent for 2017-18 and 3 per cent for next year

* Rs 10,000 crore allocated for recapitalisation of PSU banks: Arun Jaitley

* Total expenditure of Budget 2017-18 placed at Rs 21.47 lakh crore: FM

Head post offices to be used as passport offices, says FM Jaitley

* National Testing Agency to be established to conduct all entrance exams for higher education: :FM

* Crude oil strategic reserves to be set up in Odisha and Rajasthan apart from 3 already constructed

* For transport sector, including railways, road and shipping, government provides Rs 2.41 lakh crore

* Budget allocation for highways stepped up to Rs 64,000 crore in FY18 from Rs 57,676 crore

* Selected airports in tier-II cities to be taken up for operations, development on PPP mode

* Aadhar enabled payment system to be launched soon;Banks have targeted to introduce additional 10 lakh Point-of-Sale terminals by March 2017: FM

* Govt considering legislative changes to confiscate assets of fugitives of economic crimes till they submit to Indian law: FM

* Payees of dishonoured cheques to realize their payment through amendments in the negotiable instruments act: FM

* Comprehensive pension system, centralized travel ticket system for defence forces: FM Jaitley

* Propose to double the lending target of Pradhan Mantri Mudra Yojana and set it up at Rs 2.44 lakh crore for 2017-18: FM

* Delhi and Jaipur to have solid waste management plants and five more to be set up later

* Chandigarh and eight districts of Haryana have been declared Kerosene free: FM Jaitley

* New computer emergency response team will be set up for better cyber security in financial sector: FM

* Mission Antyodaya to bring 1 crore households out of poverty and to make 50,000 Gram Panchayats poverty-free: FM Jaitley

* Propose to create integrated PSU oil major, says FM

* India on the cusp of a massive digital revolution; financial inclusion and JAM important precursors to current push for digital payments: FM

* Action plan to eliminate Kala Azar & Filariasis by 2017, Leprosy by 2018, Measles by 2020 & Tuberculosis by 2025: FM

* IRCTC, IRFC, IRCON to be listed in stock exchanges: FM

* Govt to abolish the FIPB this year, necessary announcements to be made in due course: FM

* Infrastructure allocation at Rs 3,96,135 crore: FM

* Railway tariffs to be fixed on the basis of cost, social obligation and competition

* Integration of all ticketing services on one app. Integration of all customer feedback and complaint forums on one app

* Sign MoUs with zonal railways to enhance commitment on performance on clearly stated parameters

* Government proposes Coach Mitra facility to redress grievances related to rail coaches

* Launch of Tejas Express - New product offering for premium customers

* Unmanned railway level crossings to be eliminated by 2020: FM

* Railway line of 3,500 km will be commissioned in 2017-18 as against 2,800 km in 2016-17

* Launch multi purpose stalls on stations

* Encourage employment for SC/ST through horticulture and tree plantation at side of tracks

* All train coaches will be fitted with bio-toilets by 2019. One divyang toilet per platform on A1 class stations: FM

* A system of annual learning outcome in schools to be introduced; innovation fund for secondary education to be set up: FM.

Service charges on rail tickets booked through IRCTC to be withdrawn: FM

500 railway stations to be made disabled friendly: FM

* FM Jaitley proposes setting up of Rs 1 trillion fund for rail safety. Rail safety fund with corpus of Rs 100,000 crore will be created over a period of 5 years.

* A new metro rail policy will be announced, this will open up new jobs for our youth: FM Jaitley

* We will focus on passenger safety, cleanliness and overhauling accounting practices. Railway lines of 3,500 km to be commissioned in 2017-2018: FM

* Rs 1.31 lakh crore cap fixed for Railways in 2017-18 including Rs 55,000 cr to be provided by govt: FM

* PM Kaushal Kendras will be extended to 600 districts; 100 international skill centres to be opened to help people get jobs abroad

* Rs 500 cr allocated to set up Mahila Shakti Kendras; Allocation raised from Rs 1.56 lakh cr to Rs 1.84 lakh cr for women & child welfare.

* Aadhar based smart cards with health and other details to be introduced for senior citizens: FM

* Two news AIIMS to be set up in Jharkhand and Gujarat: FM Jaitley

* Dedicated micro-irrigation fund will be set up by NABARD to achieve goal of 'Per Drop More Crop'. Initial corpus will be Rs 5000 crore:FM

* 1.5 lakh health sub-centres will be transformed to health wellness centres. Propose to amend the Drugs and Cosmetics Act so that essential drugs are available at reasonable prices: FM

* SANKALP – 4000 crores allotted to train for market oriented training. At least 3.5 crore youth will be provided market-relevant training under Sankalp programme

* A system of annual learning outcome in schools to be introduced; innovation fund for secondary education to be set up: FM.

* We propose to provide safe drinking water to 28,000 arsenic and fluoride affected habitations

* Sanitation coverage in villages has increased from 42 pc in Oct 2016 to 60 pc, a rise of 18 pc, says FM

* Rules will be framed for Medical Devices. Rules to be in international harmony: FM

133-km road per day constructred under Pradhan Mantri Gram Sadak Yojana as against 73-km in 2011-14

* Total allocation for rural, agricultural and allied sectors for 2017-18 is Rs 187223 cr, which is 24% higher than last year: FM

* Aim to create 1 crore houses by 2019. PM Awas Yojana to get Rs 23,000 cr this year

100% village electrification will be achieved by May 1 next year: FM Jaitley

* Participation of women in MNREGA has increased to 55%. Budget allocation to MNREGA increased to a record Rs 48,000 crore for 2017-18, from Rs 37,000 crore in 2016-17: Jaitley

* Govt to provide core banking support to NABARD. Allocation of irrigation fund to be increased by Rs 20,000 crore: FM

* National agriculture markets to be expanded to 585 markets. Dairy processing infra fund will be created with corpus of Rs 8,000 crore in three years

Demonetisation, GST and Jan Dhan-Aadhaar-Mobile (JAM) will be epoch-making events in India's economic history: FM

* Target of Rs 10 lakh crore agricultural loans this year: FM Jaitley

* Fasal Bima Yojana coverage will be increased to 40 per cent. Issuance of soil health cards has gathered momentum. We will up crop insurance coverage to 50 percent in FY19.

* Committed to double farm income in 5 years, says FM

* Govt aims to spend more in rural areas, infra, poverty alleviation: FM

* Agri sector expected to grow at 4.1% in current year: FM

* Agenda for next year to transform, energise, Clean India: Jaitley

* Focus areas this Budget to be farmers, rural employment and infra: Jaitley

'I am reminded of what our father of the nation Mahatma Gandhi said ‘a right cause never fails’, says FM Jaitley

* Pace of remonetistion picked up, soon reach a comfortable level: Jaitley

The GDP will be bigger, cleaner and real, says Finance Minister

* Effects of demonetisation not expected to spill over to the next year: Jaitley

* Demonetisation broke parallel economy. It seeks eliminate black money, corruption, counterfeiting: Jaitley

* Demonetisation was series of continuation of decisions taken in last two years. It was a bold and decisive step: Jaitley

* Surplus liquidity in the banking system due to demonetisation will boost economic activity: FM

* India has become the sixth largest manufacturing country in the world, up from the ninth position earlier: FM

* FDI rises to 1,45,000 crore rupees in first half of 2016-17: FM

* Our CPI inflation has fallen, current account deficit has reduced, FDI flows have increased while forex reserves have increased. The government is continuing on path of fiscal consolidation: FM

* World Bank expects GDP growth rate at 7.6 pc in FY18 and 7.8 pc in FY19: FM

* India seen as an engine of global growth: Jaitley

* We are moving from informal to formal economy & the Government is now seen as a trusted custodian of public money: FM Jaitley

* Finance Minister Arun Jaitley begins Budget speech

* As a mark of respect the House should be adjourned today. The Budget can be presented tomorrow: Kharge

* Instead the House will be adjourned tomorrow as a mark of respect for E Ahamedji: Speaker

* I would have adjourned the House, but today's sitting has been fixed by the President for presentation of Budget 2017: Speaker

* Speaker offers obituary references to former Union minister E Ahamed

* Budget a constitutional obligation. Saddened by Ahamedji's demise but Budget will be presented. Obituary will be there: Speaker Sumitra Mahajan

* I offer my condolences; Budget shouldn't be presented today: Lalu

* PM Modi reaches Parliament. Cabinet meet begins in Parliament.

PM Modi, Rajnath Singh, Venkaiah Naidu, Ananth Kumar visit Ahamed's resident to pay homage

* Postponement of budget will be no big deal, its not as if secrecy will break: Former PM HD Deve Gowda

* I think government already knew that he had passed away, but they were trying to maybe delay announcement, says Congress leader Mallikarjun Kharge

* This was an inhuman act: Mallikarjun Kharge

* In our opinion,including JD(U) leaders and former PM Deve Gowda, the budget should be postponed: Kharge

* Cabinet meeting to be held shortly in Parliament

* Finance Minister Arun Jatley reaches the Parliament

* There is a precedent, in the past also a sitting MP/MoS passed away and budget was presented: Govt sources

* Budget copies reach Parliament

Parliament ususally adjourns for a day after the death of a sitting MP, although government sources cited a precedent where the Budget presentation had still gone ahead in a previous year.

Lok Sabha speaker Sumitra Mahajan is expected to take a call on the matter. Mahajan will consult the Lok Sabha Secretary General, Parliamentary Affairs Minister Ananth Kumar, opposition leader Mallikarjun Kharge and the Attorney General before deciding on the change in format.

FM Jaitley will today present the Union Budget 2017, breaking the 92-year-old practice of presenting it on the last working day of February. Also, it will be the first time when a combined Union and Rail Budget will be announced.

Expectations are running high to boost the Indian economy which suffered a blow from the government’s demonetisation move, particularly sectors like agriculture and retail which are largely dependent on cash transactions.