As the deadline to file income tax returns (ITRs) for the income earned in the 2024-25 fiscal year nears its end, the Income Tax Department's IT return filing portal is facing huge traffic. This has led to netizens complaining of glitches and demanding an extension of the September 15 deadline. However, the department has already clarified that the deadline for filing of income tax returns (ITRs) by individuals, HUFs and those who do not have to get their accounts audited for the financial year 2024-25 (AY 2025-26) will not be extended beyond September 15, 2025. The original due date was July 31, 2025. The department also stressed that the portal is working fine.

Users Complain Of Glitches

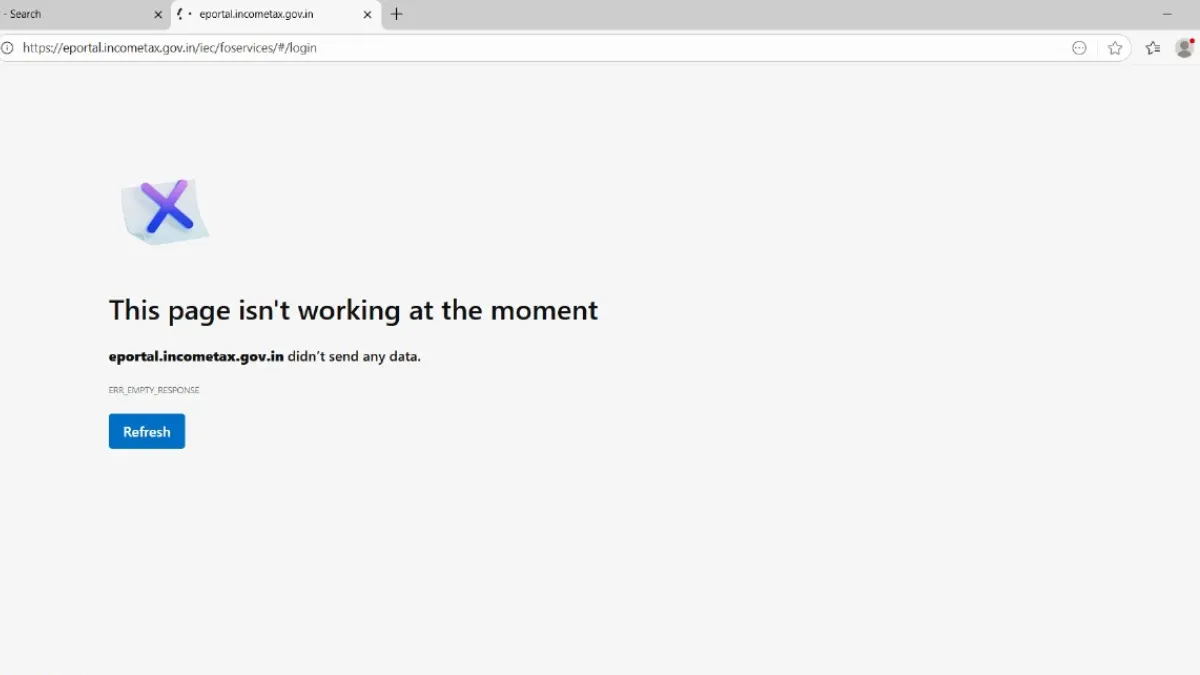

Many chartered accountants and individuals have posted on social media about problems with the Income Tax (I-T) portal. They reported issues with making tax payments and downloading the Annual Information Statement (AIS).

On Monday, users complained that they could not log into the e-filing portal.

On September 14, in response to complaints about downloading AIS/TIS, the I-T department said, "The AIS/TIS facility is working without any issues. Please try accessing it again. If you still face difficulties, share your details, including your mobile number and public IP address, at cmcpc_support@insight.gov.in."

7.28 Crore ITRs Filed Last Year

By the afternoon of September 13, over six crore ITRs had been filed, according to the tax department. Last year, 7.28 crore ITRs were filed by the July 31 deadline.

In May, the department announced an extension for filing ITRs for Assessment Year (AY) 2025-26 (for income earned in the financial year 2024-25). This extension changed the deadline from July 31 to September 15 due to necessary updates to the ITR forms.

These updates also required changes to the filing tools and back-end systems.

ITR filings have increased consistently in recent years, indicating enhanced compliance and a broader tax base. For AY 2024-25, a record 7.28 crore ITRs were filed by July 31, 2024, compared to 6.77 crore for AY 2023-24, marking a 7.5 per cent increase from the previous year.