Budget 2026: Tax holiday for cloud and data centre companies till 2047 announced

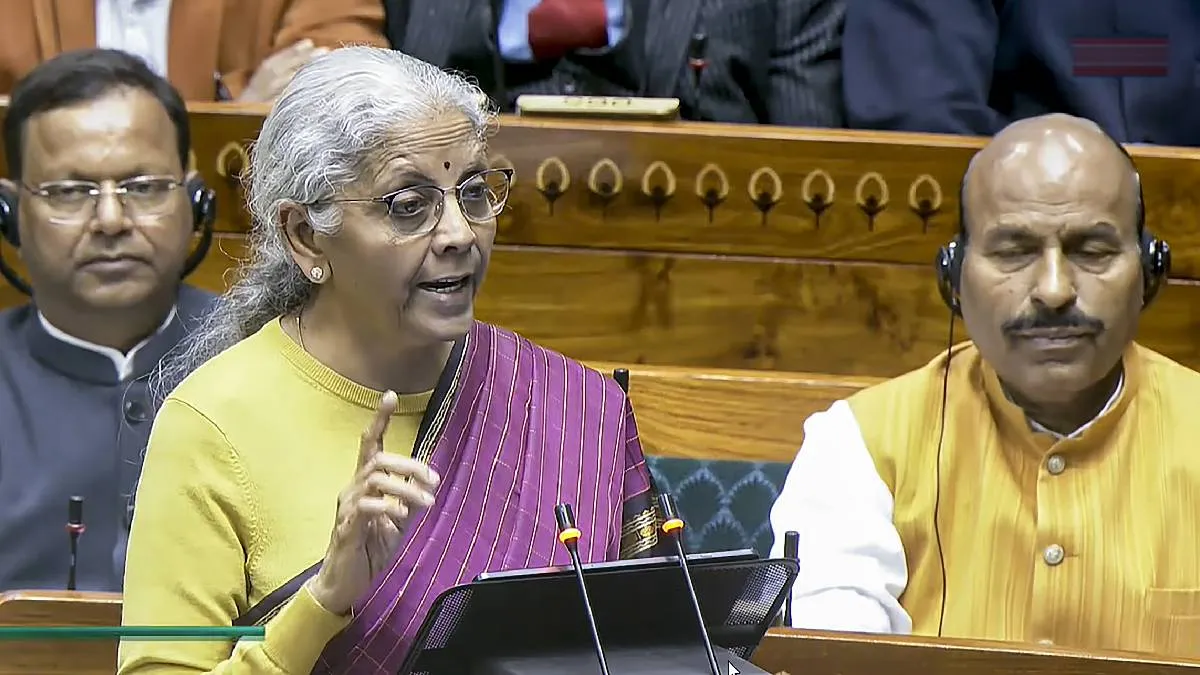

Union Finance Minister Nirmala Sitharaman announces a tax holiday for cloud services and data centre services companies till 2047 during the Union Budget 2026–27 presentation in Parliament.

Union Finance Minister Nirmala Sitharaman on Sunday proposed a tax holiday until 2047 for foreign companies providing cloud services to customers worldwide using Indian data centres. The tax holiday will be extended to eligible entities subject to certain conditions. To avail of the benefit, companies must provide services to Indian customers through an Indian reseller entity.

“I propose to provide tax holiday till 2047 to any foreign company that provides cloud services to customers globally by using data centre services from India,” the Finance Minister said.

The initiative aims to enable critical infrastructure and boost investment in data centres across the country.

India Semiconductor Mission 2.0 launched with Rs 40,000 crore outlay

Sitharaman also announced the launch of India Semiconductor Mission (ISM) 2.0, with an outlay of Rs 40,000 crore, aimed at boosting the country’s semiconductor ecosystem.

The initiative will focus on:

- Producing equipment and materials

- Designing full-stack Indian intellectual property (IP)

- Strengthening semiconductor supply chains

While presenting the Union Budget 2026, the Finance Minister stated that ISM 2.0 will emphasise industry-led research and training centres to develop advanced technology and a skilled workforce.

High-powered ‘Education to Employment and Enterprise’ committee proposed

The Finance Minister proposed setting up a High-Powered ‘Education to Employment and Enterprise’ Standing Committee to recommend measures positioning the services sector as a core driver of Viksit Bharat, with the goal of making India a global leader in services.

Assessment of AI and emerging technologies

The committee will also assess the impact of emerging technologies, including AI, on jobs and skill requirements, and propose appropriate measures to address these changes.

ALSO READ: Budget 2026: MACT interest exempt from income tax, TDS scrapped

Budget 2026: MACT interest exempt from income tax, TDS scrapped