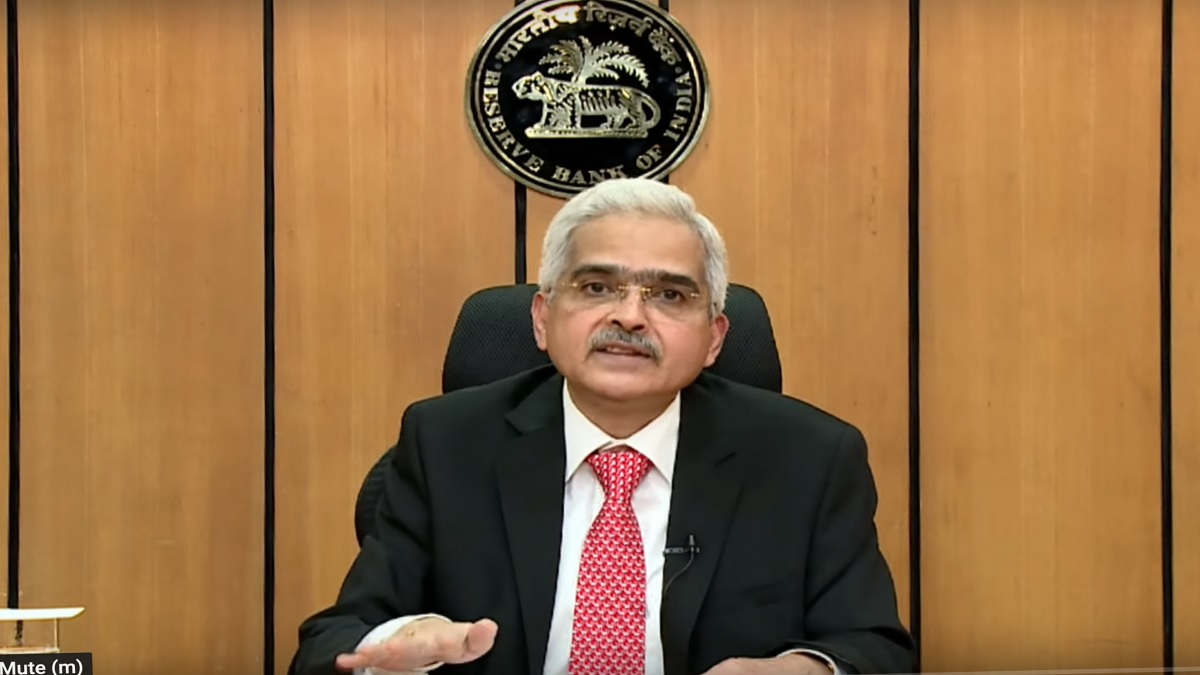

RBI Governor Shaktikanta Das has said the risk of a second wave of COVID-19 could put sand in the wheels of the nascent recovery while his deputy M D Patra opined that it might take years to regain the output lost on account of the pandemic. These views were expressed by them during the meeting of the newly constituted Monetary Policy Committee (MPC) held from October 7 to 9.

The newly appointed independent member of the rate-setting panel Shashanka Bhide said uncertainties relating to the COVID-19 pandemic will impact growth and inflation scenarios in the next two to three quarters.

Das also said the decision to cut the benchmark repo rate would depend upon the evolving situation with regard to inflation which is currently above the tolerance level of the central bank, according to the minutes of the meeting released by RBI on Friday.

"I recognise that there exists space for future rate cuts if the inflation evolves in line with our expectations. This space needs to be used judiciously to support recovery in growth," Das said.

As per the central bank's assessment, headline inflation would moderate in the second half of the current financial year and further in the first quarter of the next fiscal.

Inflation remained above the upper tolerance threshold of 6 per cent since June, with signs of aggravation of price pressures. The government has asked RBI to keep inflation at 4 per cent (+, - 2 per cent).

Speaking about the risks to growth, Das said there are downside uncertainties that could put sand in the wheels of this nascent recovery. "Primary among them is the risk of a second wave of COVID-19. Private investment activity is likely to be subdued, even as domestic financial conditions have eased significantly," he noted.

In the first quarter of this fiscal, India's GDP contracted 23.9 per cent.

Deputy Governor Patra said that India has entered a technical recession in the first half of the year for the first time in its history.

"GDP is an aggregative indicator of economic activity and hides the extent of human misery and the loss of social and human capital caused by the health crisis.

"Nonetheless, if the projections hold, the level of GDP would have fallen approximately 6 per cent below its pre-COVID level by the end of 2020-21 and it may take years to regain this lost output," he said.

While voting for keeping the interest rate unchanged, RBI Executive Director Mridul K Saggar expressed concern that if current real negative interest rates fall further, it may generate significant distortions that could adversely affect aggregate savings, current account and medium-term growth in the economy.

"With retail fixed deposit rates currently ranging between 4.90-5.50 per cent for tenors of 1-year or more and the headline inflation prevailing above that for some months now, there has been a negative carry for savers. While expected future inflation is lower and leaves some policy room, it is prudent to hold policy rates for now," he said.

All members of the MPC -- Shashanka Bhide, Ashima Goyal, Jayanth R Varma, Mridul K Saggar, Michael Debabrata Patra and Shaktikanta Das – unanimously voted for keeping the policy repo rate unchanged.

They also voted to continue with the accommodative stance as long as necessary to revive growth on a durable basis and mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward.

The benchmark interest rate was left unchanged at 4 per cent.