How Google’s Rapid AI growth helped Gemini pull ahead of OpenAI

Alphabet’s aggressive investments in artificial intelligence are beginning to deliver tangible results, helping Google’s Gemini platform gain momentum against OpenAI. A strong performance across consumer, enterprise, and cloud businesses has strengthened Wall Street’s confidence in Alphabet’s AI str

Alphabet’s big bets on artificial intelligence are finally paying off, and you can see it in how Google’s Gemini platform is catching up to OpenAI. Strong results across everything – consumer, enterprise, and cloud – have won Wall Street over on Alphabet’s AI strategy. Just a year ago, investors seemed doubtful. Now? The mood has flipped.

After launching Gemini 3, Alphabet’s execs sounded more confident than ever on their latest earnings call. It was their first big update since the new model dropped, and the message was clear: Google’s not just in the AI race, it’s leading. Last year, people thought Google was trailing the pack. Now, the company is painting itself as the one to beat. They didn’t call out OpenAI by name, but the comparison was obvious—Alphabet’s AI push is lifting results everywhere, not just in a few corners.

Sundar Pichai, Alphabet’s CEO, said they are seeing AI boost revenue “across the board.”

That’s given them the guts to ramp up spending on AI infrastructure. They’re talking about nearly doubling capital expenditures by 2026, up to USD 175 to USD 185 billion, mostly to expand AI computing power.

In the past, Alphabet’s AI updates focused on things like cloud usage and specific product numbers. This time, they’re pointing to broader financial gains, not just in the cloud but in consumer and enterprise,e too.

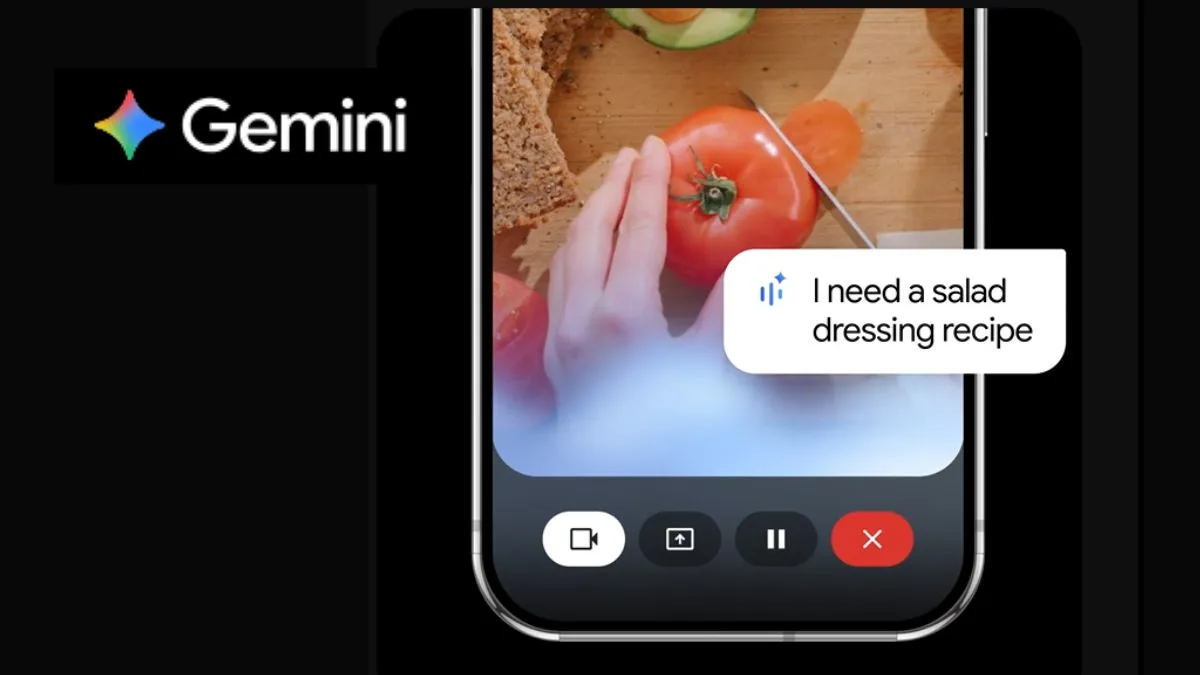

The Gemini app keeps growing. By the end of December, it hit 750 million monthly active users, up from 650 million the previous quarter. Sure, it’s still a bit behind ChatGPT, which reportedly boasts more than 800 million weekly users, but the gap’s closing fast. Since Gemini 3 launched, users have got way more engaged. The new model now runs AI Mode in Google Search and is the backbone of Google’s enterprise Gemini suite, which already has 8 million paying licences.

At first, Alphabet’s huge spending plans spooked investors, and the stock dropped 6 per cent after hours. But then Alphabet reported a 48 per cent jump in cloud revenue for the December quarter. That settled nerves, and the stock bounced back. Really, Wall Street seems fine with the AI spending—just as long as the returns keep coming in.

Alphabet’s gone from AI underdog to leader among the “Magnificent Seven” tech giants since last year. It now sits alongside Nvidia and Apple, with a market cap of over USD 4 trillion. Meanwhile, Microsoft has drawn heat over its financial ties to OpenAI. Companies heavily tied to OpenAI, like Oracle and Microsoft, have seen their stocks drop, while Alphabet’s shares are up about 36 per cent over the same stretch.

Analysts say Alphabet’s strong balance sheet and steady revenue make it a safer bet than companies tangled up with OpenAI’s funding needs. With big infrastructure and product deals at places like Meta and Apple, Alphabet’s AI business looks more self-sustaining by the day. Right now, it sure feels like Google’s got the upper hand in the AI race.