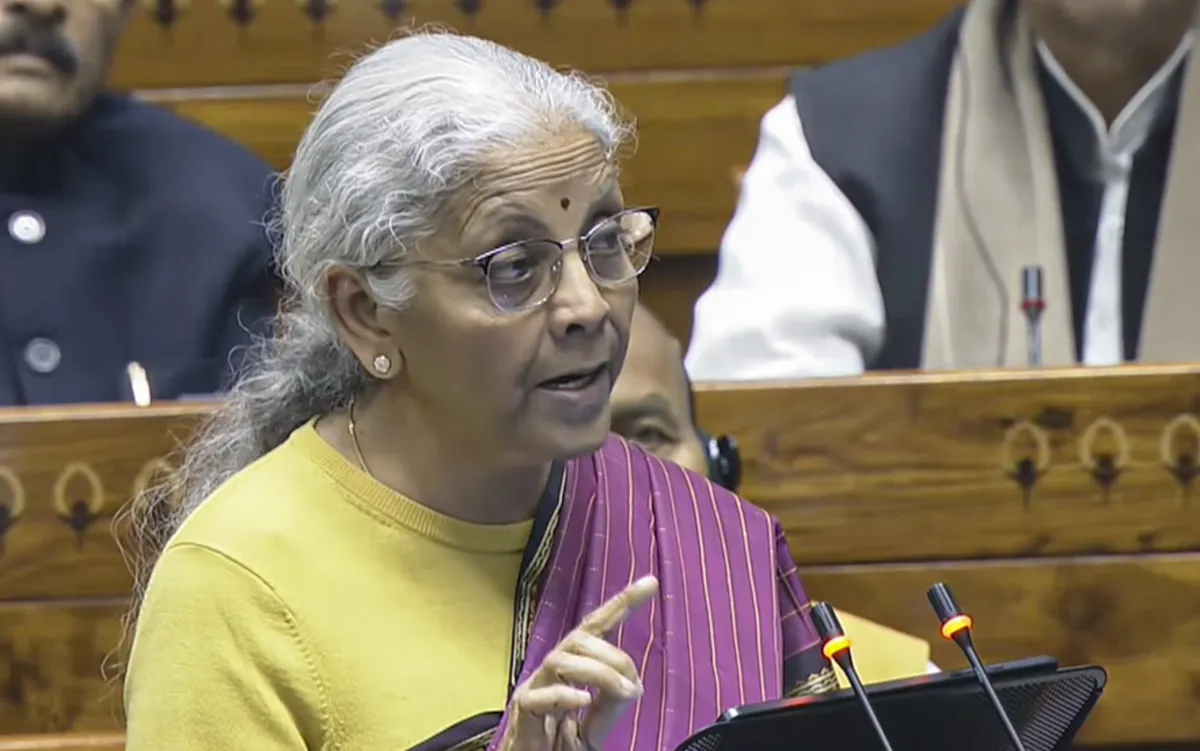

Budget: From no changes in income tax rates to new ITR deadline, key announcements by Sitharaman

Sitharaman proposed to exempt Minimum Alternate Tax (MAT) for non-residents who pay tax on presumptive basis.

New Delhi:

Union Finance Minister Nirmala Sitharaman on Sunday presented the Union Budget 2026 and said the Income Tax Act, 2025 will be implemented from April 1 and rules and tax returns forms will be notified shortly. Check top 10 highlights of her speech:

- Beginning April 1, the Income Tax Act, 2025, will come into force replacing the six-decade-old tax law and the changes made in tax laws in 2026-27 Budget will be incorporated in the new legislation.

- In her Budget speech in the Lok Sabha on Sunday, she said, "This (direct tax code) was completed in record time and the Income Tax Act 2025 will come into effect from first April 2026. The simplified income tax rules and forms will be notified shortly, giving adequate time to taxpayers to acquaint themselves with its requirements."

- The forms have been redesigned, such that ordinary citizens can comply without difficulty, she added.

- The 2025 I-T law is revenue neutral with no change in tax rates. It has only made direct tax laws simple to understand, removed ambiguities, thereby reducing scope for litigations. It reduces text volume and sections by about 50 per cent vis-a-vis the 1961 Income Tax Act.

- The new law simplifies the tax timeline by doing away with the distinction between the assessment year and the previous year, replacing it with a single "tax year" framework.

- It also allows taxpayers to claim TDS refund even when ITRs are filed after deadlines, without any penal charges.

- Sitharaman proposed to exempt Minimum Alternate Tax (MAT) for non-residents who pay tax on presumptive basis.

- She said the threshold for availing safe harbour for IT services is being enhanced from Rs 300 crore to Rs 2,000 crore.

- Sitharaman aso added that the tax collected at source rate on liquor, scrap, and mineral has been rationalised to 2 per cent. The minister also announced to rationalise definition of accountants for safe harbour rules to promote home-grown accounting firms.

- FM Sitharaman also proposed tax holiday till 2047 for foreign companies that provide cloud services to customers worldwide by using data centres in the country. The tax holiday will be extended to the entities concerned subject to certain conditions.

Also Read:

Budget 2026 is driven by 3 kartavyas of growth, aspirations, Sabka Saath Sabka Vikas: FM Sitharaman