PAN Aadhaar Link Status: How to link Aadhaar with PAN before March 31 deadline - step-by-step guide

PAN Aadhaar Link Status: The deadline for linking Aadhaar and PAN has been extended multiple times but the current deadline is March 31, 2023.

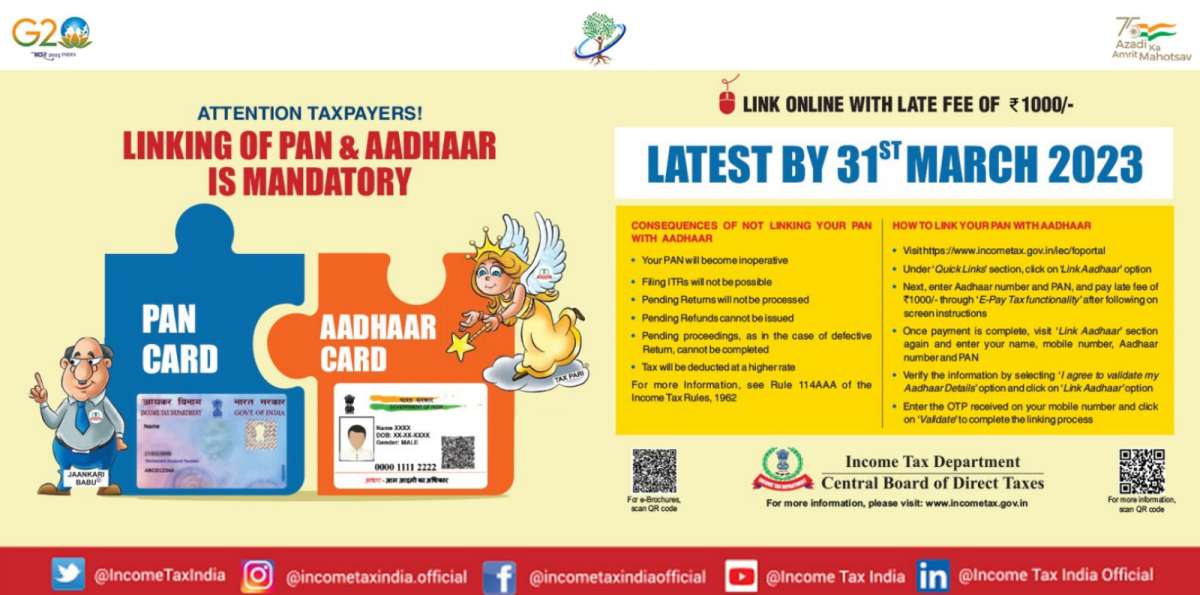

PAN Aadhaar Link Status: The Government of India has made it mandatory to link Aadhaar number with their PAN (Permanent Account Number) for filing tax returns. This is aimed at curbing tax evasion and ensuring that all taxpayers are accounted for. The deadline for linking Aadhaar and PAN has been extended multiple times but the current deadline is March 31, 2023. Failure to link your Aadhaar and PAN can result in the invalidation of your PAN card and penalties for non-compliance.

Those who have not yet linked their Aadhaar and PAN cards will now be required to pay a fee for the linkage process. As per the official website of the Income Tax Department, Aadhaar-PAN linking was free of cost before March 31, 2022. However, starting from April 1, 2022, a fee of ₹500 was imposed, which was later increased to ₹1,000 from July 1, 2022.

ALSO READ: EPFO fixes 8.15% interest rate on employees' provident fund for fiscal 2022-23

Fortunately, the process of linking your Aadhaar and PAN can be done easily and quickly from your smartphone. Here are the steps to follow:

Here is a detailed step-by-step process to link your Aadhaar card and PAN card:

Step 1: Go to the official website of the Income Tax Department of India, incometaxindiaefiling.gov.in

Step 2: Look for the 'Link Aadhaar' option, which is usually available on the homepage of the website. If you can't find it, try searching for it in the search bar provided on the website.

Step 3: Once you find the 'Link Aadhaar' option, click on it to proceed.

Step 4: You will be directed to a new page where you need to enter your PAN and Aadhaar card details. The required details include your name, Aadhaar number, and PAN number.

Step 5: Double-check the details you have entered to ensure that they are accurate.

Step 6: Once you have confirmed that the details entered are correct, click on the 'Link Aadhaar' button to initiate the linking process.

Step 7: A fee of 1000 will be deducted, of which an acknowledgment slip will be provided.

Step 8: A pop-up message will appear on the screen, confirming the successful linking of your Aadhaar card and PAN card.

Completing the process of linking your Aadhaar and PAN is a fast and straightforward task that can be done in a matter of minutes. By doing so, you will comply with the government's regulations and avoid any penalties or complications when it comes to filing your taxes.