Sensex Slips 26 Pts On Profit-Booking, Weak Global Cues

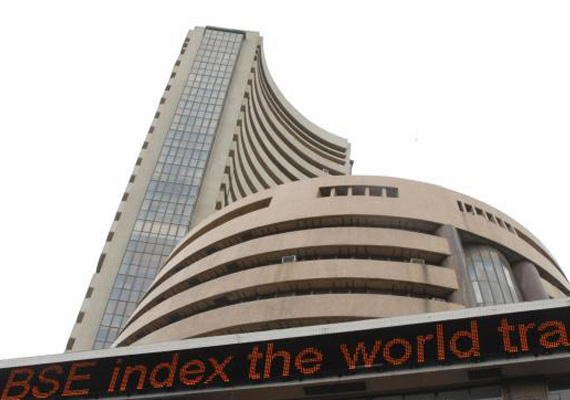

Mumbai, Jan 5: Erasing intra-day gains, the BSE Sensex slipped 26 points to 15,857.08, down for the second day today as investors remained cautious ahead of third quarter corporate results despite a sharp slump in

Mumbai, Jan 5: Erasing intra-day gains, the BSE Sensex slipped 26 points to 15,857.08, down for the second day today as investors remained cautious ahead of third quarter corporate results despite a sharp slump in food inflation.

Equity markets were weak globally as well.

Sensex heavyweight RIL fell 2.4 per cent on reports that natural gas output from its eastern offshore KG-D6 fields dipped below 39 million cubic meters a day as it shut five wells because of high water ingress.

Other majors—Infosys, ONGC, Bharti Airtel, NTPC, Coal India, HUL and DLF also weighed down the market.

However, surge in HDFC, L&T, Bajaj Auto, M&M, ICICI Bank and Hero MotoCorp checked a big fall.

The Bombay Stock Exchange 30-share barometer remained in the green most of the time, but fell towards the end and closed at 15,857.08 - down 25.56 points or 0.16 per cent.

However, the 50-issue NSE index Nifty finished flat at 4,749.95 from yesterday's close of 4,749.65.

Meanwhile, FIIs, after injecting Rs 325.70 crore on January 3, bought shares worth Rs 257.30 crore yesterday as per Sebi data.

“Market strengthened on reports of food inflation plunging into negative. However, the Sensex was unable to maintain the momentum after European markets opened in negative.

Weakness in index was accompanied by substantial selling pressure in Reliance counter,” said Shanu Goel, Research Analyst at Bonanza Portfolio.

Food inflation entered the negative zone at (-) 3.36 per cent for the week ended December 24, with the Prime Minister's Economic advisory panel making a case for reduction in RBI's lending rates in its monetary policy review later this month.

Markets, however, remained cautious ahead of corporate results that commence next week.

Asian markets ended mixed. Key indices in China, Japan and South Korea closed with small losses, while those in Hong Kong, Singapore and Taiwan made gains.

However, European markets were trading lower in the afternoon. CAC (France) was down 1.11 per cent, DAX (Germany), -0.67 per cent and FTSE (UK) - 0.73 per cent.

Overall, 17 of the 30 Sensex scrips closed in the red.

Realty major DLF lost 4.06 per cent, followed by NTPC (2.03 pc), Coal India (1.75 pc), Maruti Suzuki (1.66 pc), Hindalco (1.56 pc), ONGC (1.37 pc, Sterlite Ind (0.95 pc) and Bharti Airtel (0.88 pc).

However, Jaiprakash rose 2.77 pc, Bajaj Auto (2.70 pc), Hero MotoCo (2.33 pc), Tata Power (2.02 pc), M&M (1.83 pc), L&T (1.73 pc), Cipla (1.55 pc) and HDFC (1.34 pc).

Among sectoral indices, BSE-Oil & Gas dipped 1.68 pc, and Realty - 1.65 pc, while Auto firmed 1.21 pc and BSE-Capital Goods - 0.95 pct.

The total market breadth on the BSE remained positive as 1,443 stocks ended with gains, while 1,236 that finished with losses.

The market turnover was relatively low at Rs 1,948.54 crore from Rs 2,183.70 crore yesterday.