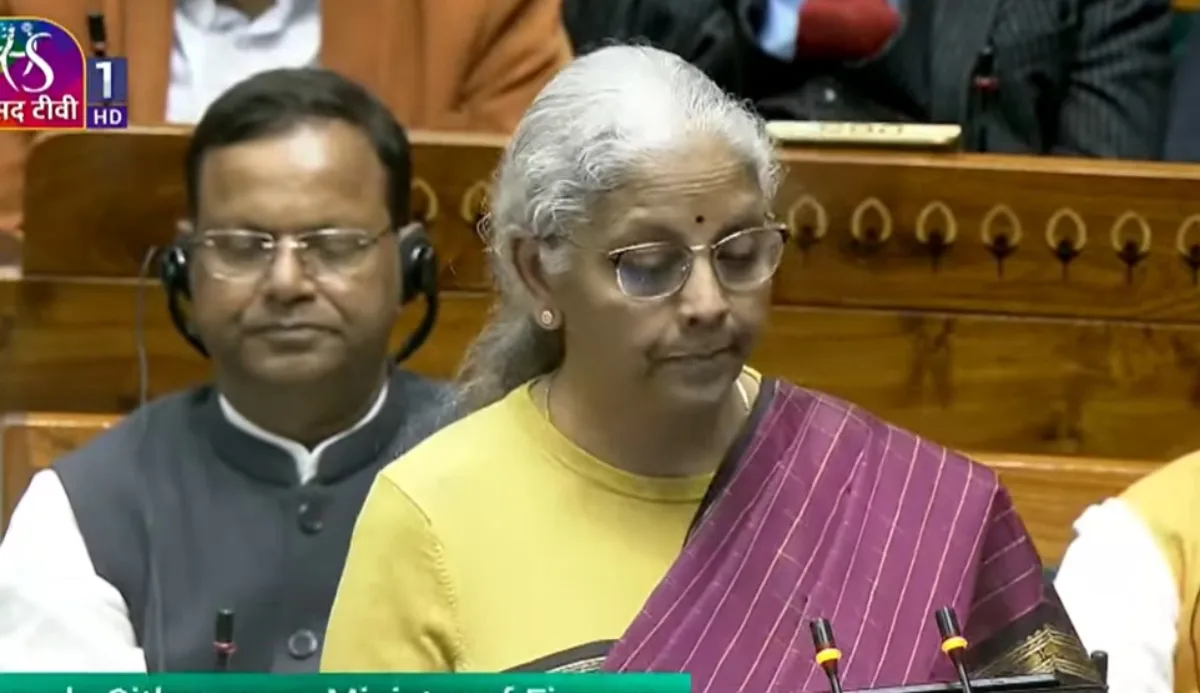

Fiscal deficit pegged at 4.3% of GDP in FY27, lower than FY26: FM Nirmala Sitharaman

The government has proposed to lower debt-to-GDP ratio to 55.6 per cent in FY27, from 56.1 per cent in the current fiscal year, Finance Minister Nirmala Sitharaman said on Sunday.

Finance Minister Nirmala Sitharaman on Sunday, in her Budget 2026 speech, said the government expects the fiscal deficit for FY 2026–27 has been pegged at 4.3 per cent of Gross Domestic Product (GDP), lower than the 4.4 per cent estimated for the current financial year, reflecting the government's continued focus on fiscal consolidation.

"In FY2026-27, fiscal deficit is seen at 4.4% of the GDP. The fiscal deficit at 4.3% of GDP in FY2027," she said.

The fiscal deficit reflects the gap between the government's total expenditure and total receipts, excluding borrowings, and is primarily financed through market borrowing.

In her 2026-27 Budget speech, Sitharaman also said the government will provide Rs 1.4 lakh crore as tax devolution amount to the states in the next financial year while the net tax receipts is estimated at Rs 28.7 lakh crore.

The size of the Budget for 2026-27 is pegged at Rs 53.5 lakh crore. In 2026-27, the fiscal deficit is estimated at 4.3 per cent, the minister said as the government moves on the fiscal prudence path of debt consolidation.

The budgeted fiscal deficit, which is the difference between the government expenditure and income, for the current fiscal (April 2025 to March 2026 or FY26), is estimated at 4.4 per cent of GDP.

A fiscal deficit of 3-4 per cent is considered comfortable and a desirable target for a growing, developing economy like India, aiming to balance economic expansion with financial stability.

Govt proposes to lower debt-to-GDP ratio

The finance minister also said the government aims to reduce the debt-to-GDP ratio to 55.6 per cent in FY 2026-27, from 56.1 per cent in the current fiscal year, underscoring its medium-term fiscal discipline roadmap.

"Coming to 2026-2027, the non-debt receipts and the total expenditure are estimated as Rs 36.5 lakh crore and Rs 53.5 lakh crore respectively. The Centre's net tax receipts are estimated at Rs 28.7 lakh crore. To finance the fiscal deficit, the net market borrowings from dated securities are estimated at Rs 11.7 lakh crore. The balance financing is expected to come from small savings and other sources. The gross market borrowings are estimated at Rs 17.2 lakh crore," said Sitharaman.

Presenting the Union Budget for 2026–27, Sitharaman announced an allocation of Rs 5,000 crore over five years for the development of CITY Economic Regions (CERs). She also said the Centre has accepted the recommendations of the 16th Finance Commission, retaining the 41 per cent tax devolution formula for states.

In addition, the government will launch a scheme for the development of the Buddhist circuit in the Northeast, aimed at preserving temples and monasteries in the region. The finance minister further proposed support for the Artificial Limbs Manufacturing Corporation of India (ALIMCO) to scale up the production of assistive devices for divyangjan.

Govt increase time limit for filing revised IT returns

Sitharaman also proposed to increase the time limit for filing revised income tax (I-T) return from December 31 to March 31, on payment of a nominal fee. The government also proposed a reduction in the TCS rate for pursuing education and medical education under liberalised remittance scheme from 5 per cent to 2 per cent.

Tax Collected at Source (TCS) rate on sale of overseas tour packages was announced to cut to 2 per cent from 5 per cent. The rate was 20 per cent earlier.

She also proposed a rule-based automated process for small taxpayers in the FY27 Budget. In her Budget speech, Sitharaman announced a proposal to exempt awards given by the Motor Accident Claims Tribunal from income tax.