Education Budget 2026: Centre's push for Corporate Mitras to support ICAI, ICSI

Education Budget 2026: The government is planning to create a pool of trained “corporate mitras” to support professional bodies- ICAI, ICSI and ICMAI in developing short-term modular courses and practical tools.

The government is planning to create a pool of trained “corporate mitras” to support professional bodies- ICAI, ICSI and ICMAI in developing short-term modular courses and practical tools.

Education Budget: Top 10 announcements on education sector

- Nirmala Sitharaman has proposed for setting up of three new All India Institute of Ayurveda

- Sitharaman has proposed for setting up of three new National Institute of Pharmaceutical Education and Research

- Five university townships will be set up

- Girls hostel will be established in every districts

- Centre proposed for setting up of one National Institute of Design (NID)

- Centre has proposed to reduce TCS rate for pursuing education and for medical purposes under the liberalised remittance scheme, popularly known as LRS, from 5 per cent to 2 per cent

- Government has proposed the formation of high-level committee in the area of 'Education to Employment and Entrepreneurship'. This committee will recommend measures focused on the services sector as a key driver for a developed India.

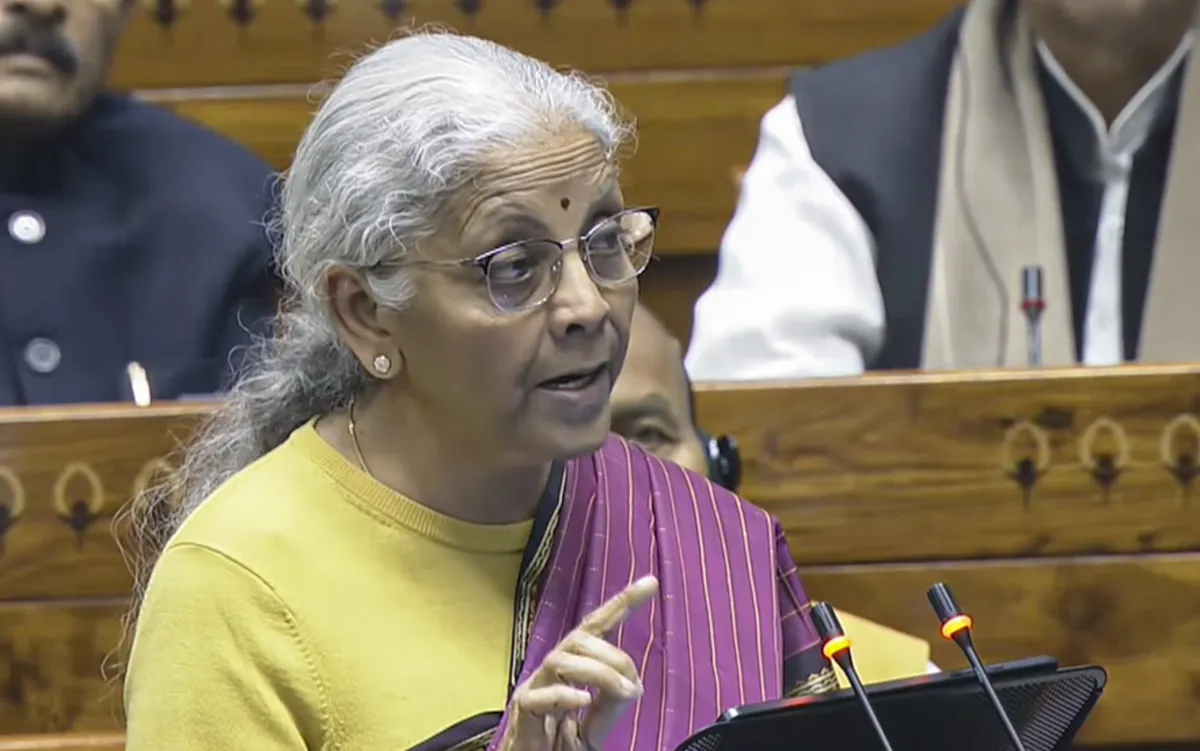

Nirmala Sitharaman, Union Finance Minister, announced a series of tax-related proposals in the Union Budget 2026 aimed at improving ease of living, simplifying compliance and providing relief to common taxpayers. Presenting the Budget in Parliament, the Finance Minister said the government's focus is on making the income tax system simpler and more citizen-friendly. As part of this effort, she announced that any interest awarded by the Motor Accident Claims Tribunal to a natural person will be exempt from income tax. This move is expected to directly benefit accident victims and their families, ensuring that compensation received is not reduced due to tax deductions.

Sitharaman also announced a major reduction in tax collection at source (TCS) on overseas spending. She proposed to reduce the TCS rate on the sale of overseas tour programme packages to 2 per cent. Currently, the TCS rates stand at 5 per cent and 20 per cent. The Finance Minister clarified that the reduced rate of 2 per cent will apply without any stipulation of amount, making foreign travel transactions simpler and less burdensome for taxpayers.