New York: The U.S. Federal Reserve has decided against reducing its stimulus for the U.S. economy, saying it will maintain the pace of its bond purchases because it thinks the economy still needs the support.

The Fed says it decided to hold off on slowing the $85 billion US a month in bond purchases to see more conclusive evidence that the recovery will be sustained.

In a statement after its meeting, the Fed says that the economy is growing moderately and that some indicators of labour market conditions have shown improvement. But it noted that rising mortgage rates and government spending cuts are restraining growth.

The bond purchases are intended to keep long-term loan rates low to spur borrowing and spending.

Many thought the Fed would scale back its purchases, despite mixed economic reports.

The decision to hold off on the start of tapering led to an immediate jump in North American stock markets. By the close of trading on Wednesday, the Dow Jones industrial average had climbed 147 points to close at 15,677. The S&P/TSX composite index was up 97 points to a close of 12,931.

Oil and gold prices also soared. Oil futures rose $2.65 US a barrel to settle at $108.07, while the December futures contract for gold climbed $57 to $1,367 US an ounce.

The Canadian dollar rose 0.70 cents to close at 97.83 cents US.

No `magic number`

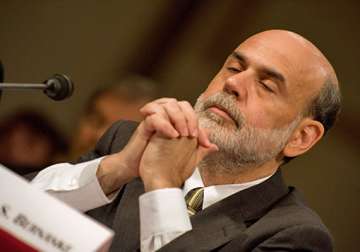

During a news conference following the Fed policy meeting, chairman Ben Bernanke said there is "no fixed schedule" date or "magic number" for when the Federal Reserve will start to slow or end its bond purchases.

Bernanke said the Fed could still move later this year. But he said that hinges on the economy showing sustained improvement. And he clarified that the program won't necessarily end when unemployment reaches seven per cent.

"What we will be looking at is the overall labour market situation, including the unemployment rate but other factors as well. There is no magic number," Bernanke said.

Andrew Busch, editor of financial newsletter The Busch Update, says quantitative easing has not been effective and it's time the Fed backed off.

“They have a major problem in that they have a huge imbalance with the Fed sheet. They need to start backing this down and stop adding to it. Why they didn't act today is beyond me,” he told CBC's Lang & O'Leary Exchange.

He said markets were surprised there was no tapering when the Fed had clearly signalled it would pull back.

“The Fed really has a major problem – messaging. How do they tell people what they are doing,” he added.

Reduces growth forecast

The Fed also issued a more downbeat outlook on the U.S. economy for 2013 and 2014 than it did three months ago.

The Fed predicts that the economy will grow just 2 per cent to 2.3 per cent this year, down from its previous forecast in June of 2.3 per cent to 2.6 per cent growth.

Next year's economic growth will be a barely healthy 3 per cent, the Fed predicts.

But the Fed's policymakers expect the unemployment rate to fall to 7.1 per cent to 7.3 per cent by the end of 2013, slightly below its June forecast of 7.2 per cent to 7.3 per cent. It predicts that unemployment will fall as low as 6.4 per cent next year, down from 6.5 per cent in its June forecast.

The unemployment rate is now 7.3 per cent.

Latest Business News